- eISSN 2353-8414

- Tel.: +48 22 846 00 11 wew. 249

- E-mail: minib@ilot.lukasiewicz.gov.pl

Jak mierzyć sukces lub niepowodzenie strategii nowego produktu na konkurencyjnych rynkach

Ireneusz P. Rutkowski

Department of Market Research and Services Management, Institute of Marketing,

Poznań University of Economics and Business, Al. Niepodległości 10, 61-875 Poznań, Poland

E-mail: Ireneusz.Rutkowski@ue.poznan.pl

ORCID: 0000-0002-3821-3533

DOI: 10.2478/minib-2022-0014

Abstrakt:

W artykule przedstawiono wskaźniki pomiaru poziomu realizacji celów strategii nowego produktu na konkurencyjnych rynkach. Metoda badawcza zastosowana w niniejszym artykule to przegląd literatury w obszarze strategii marketingowej oraz rozwoju i zarządzania nowymi produktami. Uzyskane wyniki naukowe wskazują na wagę pomiaru efektów nowej strategii produktowej oraz dostarczają różnych mierników w tym zakresie. Implikacje ekonomiczne i marketingowe badania, jego oryginalność dotyczy wyników, które stanowią podstawę doskonalenia wysiłków przedsiębiorstw w zakresie pomiaru efektów strategii nowego produktu i strategii marketingowej na konkurencyjnych rynkach. W artykule przedstawiono przegląd prac naukowych dotyczących oceny konkurencyjności nowego produktu oraz zaproponowano modyfikację metody pomiaru konkurencyjności nowego produktu na rynku. Wkład badawczy do nauki marketingu obejmuje przede wszystkim sformułowanie zestawu rzeczywistych mierników pomiaru poziomu sukcesu albo niepowodzenia strategii nowego produktu na konkurencyjnym rynku. Nowość badań polega na zaproponowaniu nowego podejścia do uzyskania parametrów ilościowych dla oceny konkurencyjności rynkowej nowego produktu w różnych branżach.

MINIB, 2022, Vol. 45, Issue 3

DOI: 10.2478/minib-2022-0014

Str. 27-44

Opublikowano 30 września 2022

Jak mierzyć sukces lub niepowodzenie strategii nowego produktu na konkurencyjnych rynkach

Introduction

New product competitiveness has important concern for industry and is decided by the interaction of marketing, finance, distribution and engineering activity with the market environment. This paper describes the characteristics of new product competitiveness in the market. The new product and market competitiveness in the field of new product strategy can be assessed at different levels-macro, meso, micro. This evaluation requires the use of appropriate measures, indicators and parameters (Juchniewicz & Grzybowska, 2010, p. 11). In particular, resolving the problem of measuring new product effects at micro level requires the availability of analytical tools that enable measurement (Wodecka-Hyjek, 2013; Hervas-Oliver, Sempere-Ripoll, Boronat-Moll, & Rojas-Alvarado, 2018). Information value and the effectiveness of monitoring of new product strategy and new product development process (NPDP) will depend on the adequacy of the metrics and parameters used. The most frequently and widely used are financial measures, on the basis of which companies exercise management control over organisational efficiency (Reinertsen & Smith, 2001; Carboni & Russu, 2018). Revenues, profits and other financial effects can be subject to manipulations (reducing companies’ expenditure on research and development [R&E] and marketing, and falsification and concealment of information). So the problem concerns what happens over time when the effects of these 'savings’ reveal a drop in new product competitiveness, and there is a decrease in the level of success of new products introduced on the market (Rutkowski, 2007).

Although expenditure on R&E is a key indicator of innovativeness, scientists have found ambiguous results regarding its effect on new product strategy and company performance. Researchers claim that variations in R&D effectiveness can be explained by changes in a company’s social system, in its new product and innovation management process. It is still unclear how innovation management influences R&D effectiveness in terms of NPDP and its maturity (Heij, Volberda, Van den Bosch, & Hollen, 2020). Managers, in response, took regulatory actions to increase new product market security and ensure sustainable development (Wheelwright & Clark, 1992; Cooper, 1993, 2019, 2021; Wu, Kefan, Gang, & Ping, 2010; Walker, 2013).

Reports from the literature on new product strategy effects, and the associated success and failure factors, contain conclusions describing critical and important issues in the NPDP. Empirical research reveals that the new product development (NPD) success rate is still at a low level and it depends on the level of NPDP maturity (Crawford, 1979; Griffin & Page, 1996; Stevens & Burley, 1997; Cooper & Edgett, 2008; PDMA, 2012; Lee & Markham, 2016; Rutkowski, 2022).

Efficiency in the area of new product strategy is defined by multiple factors, determinants and parameters; among these, one of the key ones is the competitiveness of the new product that is produced and distributed. Ultimately, in the aggregate of things, a competitive new product affects the competitive position of the company on the market.

Use of market share or relative market share measures are traditional approaches to defining new product competitiveness or market position. These measures to some extent characterise state of a company and its competitive practices. An important role in defining a company’s situation is played by the level of novelty and quality of the new competitive product. Distinguishing participants by the market share enables them to be assigned certain roles, e.g. leader or pretendent (Tyunyukova, Ruban, & Burovtsev, 2018). The results of empirical research also indicate that the market and innovation orientation is positively related to market performance of a new product. The results also show that NPD performance is highest when the market orientation and maturity of the relationship network are at a high level, which supports the proposed three-way interaction (Mu, Thomas, Peng, & Di Benedetto, 2017). So, the new product competitiveness levels for companies of different industries serve as the key factors for their success or failure on the market.

The Measures of New Product Strategy in Competitive Market

The difficulties in developing an industry standard for the success or failure of a new product can be cited. There is no appropriate consistency in defining the new product success or failure level. Each new product must have a specific strategic goal or goals. After fulfilling this goal, e.g. it can be removed from the product line. So, it was a strategic success from company’s point of view, not a failure, even though the new product was removed from the market, and it may be said that the removal would then be part of an overall strategic development.

Since the 1960s, various phenomena in NPDP have been analysed in the available literature, and the focus of research is shifting from defining the right process to ensuring its proper implementation, better management, better measurement and continuous improvement

(Rutkowski, 2007, 2021). The key factor of new product success is choice of the right new product strategy under the appropriate marketing strategy and presence of competitive advantage related either to the company or to its new product. Managers should take steps to ensure that such an advantage is effectively protected by copyright or patents, and that there are instituted measures that would effectively prevent, or at least deter and discourage, competitors from easily copying it. The competitive advantage of a company’s new product can be represented in many ways, but most of all it consists in the features or attributes of the new product, unnoticed by competitors (Thompson, Peteraf, Gamble, & Strickland, 2016). New product competitiveness is the parameter that indicates presence of such peculiarities and allows forecasting the future success of marketing activities of a company related to a new product strategy.

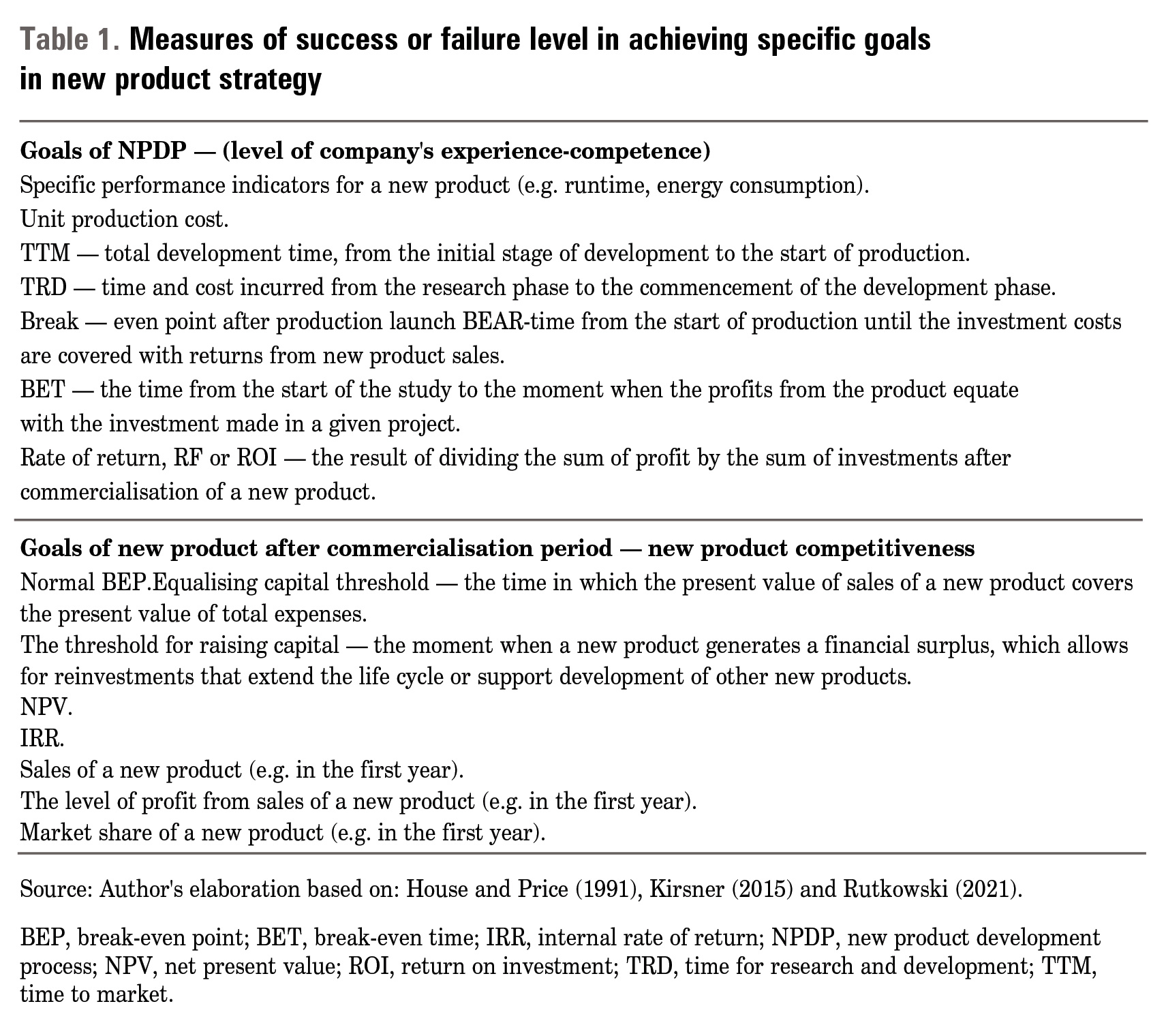

Table 1 presents selected goals of a new product strategy, which are of different financial, marketing (market) and technological nature and contain criteria in the sense that they determine the overall level of a new product’s success or failure on the market. On the other hand, the level of a new product’s success or failure on the market should be treated as a general measure of the company’s competitiveness level in the field of new product strategy, in particular the effectiveness of NPD strategy. Table 1 includes both the measures of competence and

competitiveness in achieving specific goals in NPDP (House-Price model), and the measures related to the level of achieving goals of new products after the period of commercialisation and introduction on market (Rutkowski, 2021).

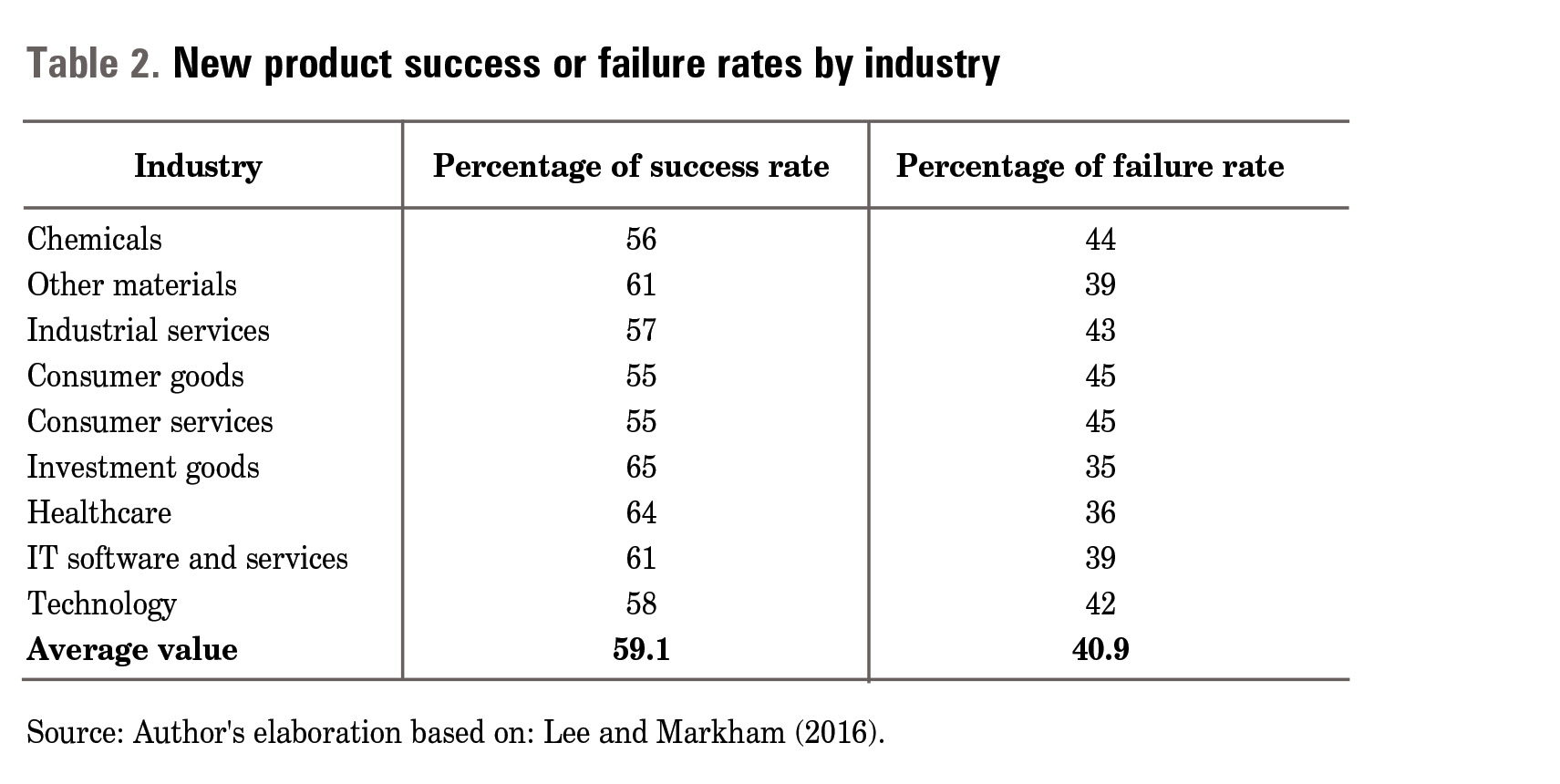

Thus, currently provided research and available knowledge point out that there is no ideal process for developing a new product, as evidenced by the longstanding relatively high rate of new product failure or partial failure on the market (Castellion & Markham, 2013; Rutkowski, 2016, 2022; Cooper, 2017). Table 2 presents new products’ success or failure rates by sector/industry. For example, consumer goods and services show a lower rate of success than the software or healthcare sectors.

The empirical studies conducted so far indicate that the implementation, realisation and control of a new product strategy should be undertaken with particular care in a company, in order to ensure efficient management of the new product offer, including appropriate coordination, integration and communication link with the existing business processes, and to achieve the goals for which this strategy is implemented (Engelman, Fracasso, Schmidt, & Zen, 2017). However, a major problem in determining the success of individual outputs is the multidimensionality of NPD results (Rutkowski, 2016).

Quantitative Rates to Assess Success Level of Project Teams in New Product Strategy

New product competitiveness or product competitiveness has been the subject of debate by academics and practitioners over many years (Takei, 1985; Oral & Kettani, 2009; Roostika, Wahyuningsih, & Haryono, 2015). There are some aspects or problems that have not been resolved due to the differing purposes of research. The question of quantitative assessment of new product competitiveness is always relevant for companies in order to determine new product strategy and functional marketing strategy, in that it enables them to arrive at decisions concerning an increase or expansion in their market positions.

An analysis of scientific publications reveals some methods and concepts for the evaluation of new product competitiveness. The main approaches may be summarised as follows (Shpak, Seliuchenko, Kharchuk, Kosar, & Sroka, 2019):

(1) Methodology of new product competitiveness evaluation through calculating its ranks and weights. According to this approach, a new product rating is dependent on the quality indicators of the new product.

(2) Methodology of the evaluation of new product competitiveness through the volume of sales. This approach assumes that the volume of sales reflects market demand (customer demand), which is why it might be the most significant criteria for the product’s competitiveness. Under modern conditions, a high volume of sales might be the result of a weak competitive environment and the absence of similar new products on the market.

(3) Methodology of the evaluation of new product competitiveness through a complex index with multiple variables. According to this approach, a complex index of new product competitiveness should include a set of partial indicators that generalise the following characteristics of new product competitiveness: customer requirements, technical

requirements and enterprise expenses.

(4) Methodology of the prediction index of competitive strength of brands based on fuzzy logic, which is based on expert knowledge bases (quality of the brand product, image of the brand product, and service connected with the brand product).

When assessing a new product strategy effects, the most useful financial measure is profit level set for a given project. Among classic marketing rates, measures of level of satisfaction and acceptance of the new product offer by clients, as well as market share index, are characterised by relatively high usability. Nevertheless, assessment based on profit level offers a useful measure reflecting the efficiency of the development and commercialisation processes and efficiency of a new product on the market.

The measures of success or failure in implementation of a new product strategy, which are used by companies, are reactive in nature. Marketing decision support systems should be more proactive from managers’ point of view (Rutkowski, 2021).

Quantitative indicators can be the basis for analysis of economic, financial and technological potential and the innovative marketing strength of companies. The values of these indicators also reflect the directions of enterprises’ conduct in NPDP and technologies, as well as in other areas of innovative activity (processes, management, organisation, sales and marketing). Moreover, these indicators inform managers about the strength of linking marketing, finance and technology with the effectiveness of new product strategy.

In last decade, a new company paradigm has arisen, which assumes that resources of marketing, organisational and technological knowledge are in central importance for the value of a company. This new way of thinking makes it necessary to formulate a new product strategy at three levels (Kasprzak & Pelc, 2012):

- shaping the company’s competencies, reflecting technological knowledge resources;

- R&E, being the sources of knowledge and new technological solutions for products and processes; and

- mastering marketing, technological processes, product manufacturing and distribution systems as tools of competition and competitiveness.

These three levels of new product strategy formulation require prognostic recognition, strategic analysis of a different nature and efficient marketing decision support systems.

Measures of New Product Competitiveness as Effects of New Product Strategy

In the scientific publications, as well as in statistical sources (Commission Regulation [EC] No. 1450/2004 of 13 August 2004), among many indicators used to compare and determine the change trends in marketing and technological strategies of various industries and companies, the following measures of enterprises’ effects in the area of new product strategy and intellectual property protection are particularly useful (OECD/Eurostat, 2018; Grzegorczyk & Głowiński, 2020):

- innovative activity intensity (IAI), research and development intensity (RDI), new products marketing intensity (NPMI);

- engagement to innovation (IE), R&E and marketing of new products (NPME)-the degree of development of intellectual resources in relation to production investments;

- new product sales index-marketing product offer renewal (NPS);

- patent activity index (PAI); and

- inventive activity index (IVAI).

Strong changes in these indicators reflect problems with market position stabilisation of a company or the industry. The author assumes that the measure of intensity of competition on the new products’ market is the indicator expressed by the formula (Rutkowski, 2021):

where SR(u,s) denotes the rate of competition (according to the share of sales [u] or sales [s]) in the new products market; SBNPi the share of sales of the i-th new product (type, line) in the industry in the total sales value of products in a given industry (or WSBNPi the sales value of the i-th new product [product type, product line] by all companies in a given industry); and SPNPi represents the share of sales of the i-th new product (type, line) in a given company in the total sales value in a given industry (or WSPNPi the sales value of the i-th new product [type, line] in a given company).

Additionally, SBNPi – SPNPi > 0; WSBNPi – WSPNPi > 0; and SR(u,s) < 0.5, 0.5 ≤ ≤ SR(u,s) < 0.65, 0.65 ≤ SR(u,s) < 0.80, 0.80 ≤ SR(u,s) < 0.95, and 0.95 ≤ ≤ SR(u,s) < 1.0, respectively, indicate very low, weak, average, strong, and very strong intensity of competition on the new products market.

The index of the intensity of competition of a new product offer on the market (SR) reflects the level of competitiveness of a new product offer of a given company or industry. It basically determines the ability of the company’s new market offer to participate in smooth adjustment processes in the changing market conditions. It shows how companies compete on the market of new products for the favour of customers, and is helpful in indicating the degree of customer acceptance of the new product offer. Therefore, this index shows the ability to survive on the market, as well as the ability to develop the company under certain conditions of competition (Rutkowski, 2021). Information about the value of new products sales in the market is generally more accessible than information about the quantity of new products sales, which is very difficult to obtain.

To empower itself to undertake projects involving new products with a high probability of success in the future, the company must monitor internal NPDPs and the situation prevailing in the marketing environment. Thus, it is important to determine the metrics/indicators/parameters that can be used by these companies to measure the competitiveness level of a new product. The use of indicators tends to bring better analytical capacity in management information system and marketing decision support system, regardless of the target industry (Zizlavsky, 2016).

The parameter of new product competitiveness on market is a much broader concept, and it may vary significantly for the same new product quality, depending on the market state, competitors’ activities, their marketing strategies and appearance of new products in the studied product line (Tyunyukova et al., 2018). Nevertheless, price, costs, quality and technical level of the new product are inherent parts of competitiveness and shall be accounted for in its evaluation. However, the overall new product attractiveness is defined by the customer. The main groups of parameters accounted when evaluating new product competitiveness are:

1. Economic (costs associated with purchase, transportation to the place of operation, installation, and irrecoverable customs duties and other taxes that have to be borne);

2. Quality systems standards (compliance with the existing regulations, compliance with technical specifications, compliance with the contract, compliance with the standards — ISO);

3. Technical (product parameters and properties, usability, service life); 4. Operational (reliability, service ability, raw materials, other materials, electric power, maintenance);

5. Ergonomic (hygienic, anthropometric, psycho-physiological, psychological); 6. Aesthetic (harmony of shape, rationality of shape, preservation of saleable condition, quality of fabrication); and

7. Marketing (price level, efficiency of distribution, effectiveness of promotion and communication systems, brand strength and

awareness).

In the process of managing the competitiveness of new products on the market, an important issue is to establish the degree of influence of each of factors on the level of competitiveness. Therefore, the selection of the most important of them at a certain stage of the integrated product’s life cycle not only allows its quality to be improved but also enables changes in market conditions with respect to properties and characteristics to be considered, reduction in production costs and improvement in the price-quality ratio (Vashkiv, 2020). The results of a study of customer needs and market requirements constitute the basis for assessing the competitiveness of new products.

Based on the work of Tyunyukov and others, the author proposes the following formula for determining the competitiveness of a new product on the market. Actions are related to selection of the above-mentioned parameters of the evaluated new product, selection of the reference sample with ideal parameters and comparison of the surveyed sample with the reference one. All methods applied for comparing the samples can be categorised by the parameter of qualitative or quantitative research of competitiveness. Combined evaluation methods are represented by assessments (obtained from experts and customers by surveys) transformed into quantitative parameters using mathematical and statistical tools. Quantitative assessment is usually performed by calculating single, group and integral indices (Gabrusewicz, 2014). The subsequent actions in analytical process are related to selection of meaningful parameters of the new product in question, selection of the reference sample with ideal parameters and comparison of the researched sample with the reference one. All methods applied for comparing the samples can be categorised by the parameter of qualitative or quantitative evaluation of competitiveness. Combined evaluation methods are represented by assessments (obtained by means of surveying experts and customers) transformed into quantitative parameters using certain mathematical and statistical tools.

Quantitative assessment is usually performed by calculating single, group and integral indices.

New product single index is defined by the formula:

where NPSI represents the single parameter index; Pl the parameter level for the surveyed new product; and PL100 the parameter level for the reference new product sample, which satisfies the need in 100%.

After finding single parameter indices, a group parameter GPi can be calculated by Formula (2), which enables single indices to be integrated for a uniform group of parameters-economic, standard, technical, operational, ergonomic, aesthetic and marketing. Single indices can be integrated using factor weight set during customer or expert surveys.

where NPGP represents the group parameter; Fi the factor weight in group parameter (e.g. marketing : price); and gi the single index.

Integral index is calculated in the format 'selected group of parameters, e.g. technical-tech/marketing-mark parameters’ (Formula [3]), which in fact provides the parameter evaluation in relation to its marketing characteristics.

where Gtech represents the group index for group of technical parameters; and Gmark the group index for group of marketing parameters.

Then, the conclusion is made: if NPH < 1, then the studied new product is inferior to the reference sample, and in case of NPH > 1, the reference sample has higher competitiveness. A significant drawback of such approach consists in the fact that only those new product parameters can be used for comparison which have a numerical value, i.e. only the physical parameters of a new product can be considered in the calculation.

The next stage is obtaining qualitative assessments of these parameters based on surveys of experts or customers. The assessment is given both to the researched new product and to that offered by the closest competitor. Based on the qualitative assessment given in the form 'very good’, 'good’, 'satisfactory’, 'bad’ and 'very bad’ to each of the parameters, coded scales by the number of parameters are built (customer or expert surveys). After transforming single responses into particular desirability functions, the new product competitiveness index NPGI will be obtained, as indicated in Formula (4):

where INDn represents individual needs/desirabilities.

Coded scales according to Harrington desirability function (Harrington, 1965) are as under: very good, 1.00–0.80; good, 0.80–0.63; satisfactory, 0.63–0.37; bad, 0.37–0.20; and very bad, 0.20–0.00.

The overall desirability function NPKI is defined as the geometric average of the individual desirability functions of each response INDn, where n is the number of responses. The optimal solutions are determined by maximising NPKI. This index enables the obtaining of a unified quantitative evaluation of new product competitiveness based on qualitative assessments of certain parameters. Considering that competitiveness is a multicomponent index influenced by marketing activities and other activities of companies, and new competitive advantages that appear as other groups of parameters can be used for new product competitiveness evaluation, these can then be introduced for calculating an optimised new product competitiveness index.

Coded scales according to Harrington desirability function (Harrington, 1965) are as under: very good, 1.00–0.80; good, 0.80–0.63; satisfactory, 0.63–0.37; bad, 0.37–0.20; and very bad, 0.20–0.00. The overall desirability function NPKI is defined as the geometric average of the individual desirability functions of each response INDn, where n is the number of responses. The optimal solutions are determined by maximising NPKI. This index enables the obtaining of a unified quantitative evaluation of new product competitiveness based on qualitative assessments of certain parameters. Considering that competitiveness is a multicomponent index influenced by marketing activities and other activities of companies, and new competitive advantages that appear as other groups of parameters can be used for new product competitiveness evaluation, these can then be introduced for calculating an optimised new product competitiveness index.

Conclusions

The paper presents the real market effects of new products, and their success and failure rates, from the point of view of companies representing various industries. The success or failure indicators, parameters and formal evaluation methods presented here are not expected to be exhaustive or to constitute an immediate and effective recipe for the competitiveness and success of a new product in the marketplace. The benefits of adoption of any type of measure presented in this paper depend on who is using the presented measurement methods. Nevertheless, the study does discuss immediate and pertinent issues by using established metrics for new product strategy effects’ assessment. The study provides useful metrics and methods of new product competitiveness evaluation that can be part of a more holistic and effective assessment of innovation projects. The statements made in the paper are based on examples of bibliographic sources and published empirical research on competitiveness and success or failure rates of a new product on the market. Useful research measures in the field of marketing and sales effects of new products are proposed. Simultaneously, the paper discusses direct and significant problems related to the use of established measures of new product success factors and product competitiveness. And at this point, it can be assumed that the present study’s indicators of the new product success on markets are better than those presented in the sources referenced in the paper. The research contained in the article provides indicators that can be part of a holistic and effective evaluation of new products on the competitive market.

References

1. Carboni, O. A., & Russu, P. (2018, March). Complementarity in product, process, and organizational innovation decisions: Evidence from European firms. R&D Management, 48(2), 210–222. doi:10.1111/radm.12284

2. Castellion, G., & Markham, S. K. (2013, September). Myths about new product failure rates perspective: New product failure rates: Influence of argumentum ad populum and self-interest. Journal of Product Innovation & Management, 30(5), 976–979.

doi:10.1111/j.1540-5885.2012.01009.x

3. Commission Regulation (EC) No. 1450/2004 of 13 August 2004 implementing Decision No. 1608/2003/EC of the European Parliament and of the Council concerning the production and development of Community statistics on innovation. Retrieved from https://eurlex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2004:267:0032:0035:EN:PDF

4. Cooper, R. G. (1993). Winning at new products. Reading, MA: Addison Wesley.

5. Cooper , R. G. (2002). Winning at new products. Accelerating the process from idea to lunch (3rd ed.). Reading, MA: Addison-Wesley Publishing Company.

6. Cooper, R. G. (2017). Winning at new products: Creating value through innovation (5th ed.). New York, NY: Basic Books.

7. Cooper, R. G. (2019). The drivers of success in new-product development. Industrial Marketing Management, 76, 36–47.

8. Cooper, R. G. (2021). Accelerating innovation: Some lessons from the pandemic. Journal of Product Innovation Management, 38, 221–232. doi:10.1111/jpim.12565

9. Cooper R.G., Edgett, S.J.(2008). Maximizing productivity in product innovation, in: Research Technology Management, March 1.

10. Crawford, C. M. (1979, September). New product failure rates-Facts and fallicies. Research Management, 22, 9–13.

11. Engelman, R. M., Fracasso, E. M., Schmidt, S., & Zen, A. C. (2017). Intellectual capital, absorptive capacity and product innovation. Management Decision, 55(3), 474–490. doi:10.1108/MD-05-2016-0315

12. Gabrusewicz, W. (2014). Analiza finansowa przedsiębiorstwa, Teoria i zastosowanie. Warszawa, Poland: PWE.

13. Griffin, A., & Page, A. L. (1996, November). The PDMA success measurement project: Recommended measures for product development success and failure. Journal of Product Innovation Management, 16(6), 478–496. doi:10.1111/1540-5885.1360478

14. Grzegorczyk, T., & Głowiński, R. (2020). Patent management strategies: A review. Journal of Economics & Management, 40(2), 37–39. doi:10.22367/jem. 2020.40.02

15. Harrington, E. C. Jr. (1965). The desirability function. Industrial Quality Control, 21, 494–498.

16. Heij, C. V., Volberda, H. W., Van den Bosch, F. A. J., & Hollen, R. M. A. (2020). How to leverage the impact of R&D on product innovation? The moderating effect of management innovation (March 2020). R&D Management, 50(2), 277–294. Retrieved from https://ssrn.com/abstract=3617110 or doi:10.1111/radm.12396

17. Hervas-Oliver, J. L., Sempere-Ripoll, F., Boronat-Moll, C., & Rojas-Alvarado, R. (2018). On the joint effect of technological and management innovations on performance: Increasing or diminishing returns? Technology Analysis & Strategic Management, 30, 569–581. doi:10.1080/09537325.2017.1343462

18. House, C. H., & Price, R. L. (1991). The return map: Tracking product teams. Harvard Business Review, 69(1), 92–100. Retrieved from https://hbr.org/1991/01/the-return-map-tracking-product-teams

19. Juchniewicz, M., & Grzybowska, B. (2010). Innowacyjność mikro przedsiębiorstw w Polsce. Warszawa, Poland: Polska Agencja Rozwoju Przedsiębiorczości.

20. Kasprzak, W., & Pelc, K. (2012). Innowacje, strategie techniczne i rozwojowe. Wrocław, Poland: Oficyna Wydawnicza Politechniki Wrocławskiej.

21. Kirsner, S. (2015). What big companies get wrong about innovation metrics. Retrieved from https://hbr.org/2015/05/what-big-companies-get-wrong-about-innovation-metrics

22. Lee, H., & Markham, S. K. (2016). PDMA comparative performance assessment study (CPAS): Methods and future research directions. Journal of Product Management, 33(S1), 3–19. Product Development & Management Association. doi:10.1111/jpim.12358

23. Mu, J., Thomas, E., Peng, G., & Di Benedetto, A. (2017, July). Strategic orientation and new product development performance: The role of networking capability and networking ability. Industrial Marketing Management, 64, 187–201.

24. OECD/Eurostat. (2018). Oslo manual 2018: Guidelines for collecting, reporting and using data on innovation (4th ed., The Measurement of Scientific, Technological and Innovation Activities). Paris, Luxembourg: OECD Publishing/Eurostat. doi:10.1787/ 9789264304604-en

25. Oral, M., & Kettani, O. (2009). Modelling firm competitiveness for strategy formulation. CIRRELT, 2009, 52, 1–39.

26. Reinertsen, D. G., & Smith, G. P. (2001). Developing products in half the time. New York, NY: Van Norstrand Reinhold.

27. Roostika, R., Wahyuningsih, T., & Haryono, S. (2015). The impacts of external competitiveness factors in the handicrafts industry. Polish Journal of Management Studies, 12(1), 166–176.

28. Rutkowski, I. P. (2007). Rozwój nowego produktu. Metody i uwarunkowania. Warszawa, Poland: Polskie Wydawnictwo Ekonomiczne.

29. Rutkowski, I. P. (2016). Metody innowacji produktu. Macierzowo-sieciowe metody pomiaru dojrzałości procesu innowacji produktu. Poznań, Poland: Wydawnictwo Uniwersytetu Ekonomicznego w Poznaniu.

30. Rutkowski, I. P. (2021). Competence measurement of production enterprises in product innovations for technological and marketing strategies. Journal of Economics & Management, 43, 114–134. doi:10.22367/jem.2021.43.06

31. Rutkowski, I. P. (2022). Success and failure rates of new food and non-food products introduced on the market. Journal of Marketing and Consumer Behaviour in Emerging Markets, 1(14), 52–61. doi:10.7172/2449-6634.jmcbem.2022.1.4

32. Shpak, N., Seliuchenko, N., Kharchuk, V., Kosar, N., & Sroka, W. (2019). Evaluation of product competitiveness: A case study analysis. Organizacija, 52(2), 107–125. doi:10.2478/orga-2019-0008

33. Stevens, Greg A. & Burley, James. (1997). 3,000 Raw Ideas = 1 Commercial Success!, Research-Technology Management, 40:3, 16–27, DOI: 10.1080/08956308. 1997.11671126

34. Takei, F. (1985). Product competitiveness evaluation-Quantitative analysis for development strategy. Technological Forecasting and Social Change, 28(2), 123–139. doi:10.1016/0040-1625(85)90010-1

35. Thompson, A. A. Jr., Peteraf, M. A., Gamble, J. E., & Strickland, A. J. III. (2016). Crafting and executing strategy-The quest for competitive advantage: Concepts and cases, 20th ed. New York, NY: McGraw-Hill.

36. Tyunyukova, E., Ruban, V., & Burovtsev, V. (2018). Modern approaches to product competitiveness evaluation for companies of various industries. MATEC web of conferences polytransport systems doi:10.1051/matecconf/201821602016

37. Vashkiv, O. (2020). Product competitiveness and stages of its evaluation. Figshare. Thesis. doi:10.6084/m9.figshare.13084097.v1

38. Walker, R. (2013). Winning with risk management. Hackensack, NJ: World Scientific Publishing.

39. Wheelwright, S. C., & Clark, C. B. (1992). Revolutionizing product development. New York, NY: The Free Press.

40. Wodecka-Hyjek, A. (2013). Wybrane narzędzia pomiaru innowacyjności. Zeszyty Naukowe. Zarządzanie, 998, 63–82. doi:10.15678/ZNUEK.2013.0922.04

41. Wu, D. D., Kefan, X., Gang, C., & Ping, G. (2010). A risk analysis model in concurrent engineering product development. Risk Analysis, 30(9):1440–1453.

42. Zizlavsky, O. (2016). Innovation performance measurement: Research into Czech business practice. Economic Research, 29(1), 816–838. doi:10.1080/1331677 X.2016. 1235983

Ireneusz P. Rutkowski — Professor of Economics at the Department of Market Research and Services at the Marketing Institute, Poznań University of Economics and Business. Expert of the National Center for Research and Development, member of the Product Development Management Association, the Polish Scientific Society of Marketing, the Scientific Society of Organization and Management and the Polish Economic Society. Author of 10 books and almost 200 other scientific and popular science publications on product strategy, product management, new product development, marketing strategies, market research methods and application of information systems in commercial enterprises.