- eISSN 2353-8414

- Tel.: +48 22 846 00 11 wew. 249

- E-mail: minib@ilot.lukasiewicz.gov.pl

Postawy polskich konsumentów wobec „czystego mięsa”

Magdalena Ankiel1*, Marta Łyko2, Bogdan Pachołek3

Uniwersytet Ekonomiczny w Poznaniu, Katedra Marketingu Produktu, al. Niepodległości 10, 61-875 Poznań, Poland

1*E-mail: magdalena.ankiel@ue.poznan.pl; marta.workplace@gmail.com

ORCID: 0000-0003-2594-1600

2ORCID: 0009-0001-6187-4030

3E-mail: bogdan.pacholek@ue.poznan.pl;

ORCID: 0000-0003-0576-1426

DOI: 10.2478/minib-2023-0025

Abstrakt:

Zrozumienie otwartości i zapotrzebowania potencjalnych konsumentów na produkt, a także ich zastrzeżeń i oczekiwań jest niezbędne przy wprowadzaniu nowego produktu na rynek, a czyste mięso nie jest tu wyjątkiem. Przeprowadzono badania w zakresie otwartości, percepcji i zastrzeżeń, ale najczęściej w formie analizy deklaracji, a nie rzeczywistych obserwacji zachowań konsumentów. Celem badania była ocena konsumenckich postaw wobec „czystego mięsa”, w szczególności akceptacji, percepcji, barier i czynników wpływających na postawę wobec „czystego mięsa”. Badanie było dobrowolne, przeprowadzone za pomocą ankiety internetowej i skierowane do respondentów w wieku do 55 lat. Próba badawcza składała się z 418 respondentów, reprezentujących zróżnicowany profil socjodemograficzny. Wyniki badania wykazały, że dla wielu respondentów mięso jest ważną częścią diety i jest często spożywane. Większość respondentów nie wiedziała, czym jest „czyste mięso”, ale po krótkim wprowadzeniu do produktu większość wyraziła chęć spróbowania go. Dostępność, smak i wyższa cena zostały zidentyfikowane jako największe bariery przed wypróbowaniem „czystego mięsa”, a potencjał wynalazku, wzbudzone zainteresowanie i postrzegane korzyści dla środowiska były cechami najbardziej kojarzonymi z tym wynalazkiem.

MINIB, 2023, Vol. 50, Issue 4

DOI: 10.2478/minib-2023-0025

Str. 115-136

Opublikowano 13 grudnia 2023

Postawy polskich konsumentów wobec „czystego mięsa”

Introduction

Overall meat consumption and demand for it have been rising for many decades and are projected to continue rising, albeit at a slower rate, compared to 10 years ago (eu.boell.org, 2021). To put the volume of consumption into numbers, global meat consumption was estimated to have grown to 320 million tons in 2018, which is more than twice, when compared to the amount consumed just 20 years ago from then. The increased global consumption can be largely attributed to the following three most significant factors – population growth, higher average incomes, and ever increasing per capita meat consumption (eu.boell.org, 2021; Sans & Combris, 2015). With respect to Polish consumers, data collected by OECD & FAO (2020) assessed that in 2019, Polish consumers ate, on average, 96.24 kg of meat, including 54.15 kg of pork, 29.51 kg of poultry, 12.44 kg of fish and seafood, 1.01 kg of beef, 0.03 kg of sheep and goat, and 0.10 kg of other meats. This amount of meat consumed annually lands on the higher end of the spectrum of meat consumption for developed countries.

Meat is commonly used as a source of protein and as a high caloric, nutritionally dense food source (Godfray et al., 2018). The evidence pertaining to since how long ago meat has been present in the human diet allows estimating this number to be over 1 million years (Klurfeld, 2015). Including meat in one’s diet may be beneficial in terms of nutrients it provides; however, it is not an essential food; and it is possible to have a complete, balanced diet without meat or any other animal product (Bakaloudi et al., 2021; Wood, 2023). Some consumers are deciding to switch from conventional meat consumption to conventional meat alternatives, which function also as an alternative protein source. Conventional meat alternatives can be divided into four groups: plantbased proteins, insect-based proteins, single cell proteins, and 'clean meat’ (Siddiqui et al., 2022a).

'Clean meat’ is meat obtained via growth of animal muscle tissue in bioreactor, which has been previously obtained from an animal via biopsy. Stem cells used for proliferation in the bioreactors are the skeletal muscle tissue obtained via biopsy of skeletal muscles from a live animal, which need to be of high quality. Those cells need to be able to self-renew, generate at the single cell-level differentiated progeny cells, and reconstitute a given tissue in vivo (Srutee et al., 2021) Cells used for growth serum come from meat harvested from an embryo of an animal, most often from a foetus of a pregnant cow, although alternatives have been developed, based on microorganisms or algae (Chirki et al., 2022). This shift from foetal bovine growth serum will enable a greater reduction in need for animal input in production of animals, making it a 'cleaner’ meat alternative (Michail, 2021). The serum formulation also includes vitamins and minerals. The methods of producing meat by cell multiplication can be divided in two advanced tissue engineering techniques, namely the scaffold-based and the self-organising techniques.

In terms of flavour profile and nutrient characteristics of 'clean meat’, producers are working on developing characteristics that will both satisfy consumers’ preferences and offer health benefits. During the production process, elements such as type of cell multiplied and type of growth medium used are carefully chosen, and characteristics such as amount of fat, cholesterol, protein, or other nutritional qualities can be manipulated to create a more desirable product for the consumer (sciencefocus.com, 2022). 'Clean meat’ quality cannot diverge from conventional meat quality if it is to achieve consumer acceptance (Vermeir et al., 2020).

The name for this product is still not universally agreed upon, although there has been research already done for both of the following objectives: (i) to arrive at and establish a name that could be used for most optimally communicating the concept of 'clean meat’ to potential consumers, which is also expected to be a name that would be in adherence to the marketing needs associated with such product; and (ii) to study the reactions of consumers to various such names. Through research, it was determined that the best five names for this product are: 'slaughter-free meat’, 'craft meat’, 'cultured meat’, 'cell-based meat’, and 'clean meat’. In the course of further research some interesting findings became apparent, when comparing reactions of the respondents to those five names: the willingness to try, buy, and find the 'clean meat’ overall appealing does not correlate with the descriptiveness of the name and how clearly a name distinguishes itself from conventional meat. The findings suggest not only that the appeal of the 'clean meat’ is connected with how it is presented but also that its appeal to consumers is dependent on the careful choice of the name. In the light of the research, the name 'slaughter-free meat’ scored the highest on average, with 47% of respondents declaring a high likelihood of buying it. The name 'cell-based meat’, although scoring the highest on the differentiation criterion and second on the descriptiveness, was least attractive in terms of perceived attractiveness by respondents; therefore, the third highest ranking name, 'clean meat’, was adopted for the purpose of this study. The reason for not choosing the name 'slaughter-free meat’ is that it does not translate well, and the reaction to the polish equivalent has not been studied, whereas the polish equivalent of 'clean meat’ is easily translatable and will be somewhat visually and audibly similar to the names for this product in other languages (Vermeir et al., 2020).

In recent years, there can be observed changes not only in the variety of meat alternatives available but also in consumer preferences in terms of meat options or protein sources, and this change is predicted to only grow in prominence (govgrant.co.uk, 2023). Just in 2025, the forecasted percentage of vegan meat alternatives is expected to grow up to 10% of overall meats consumption, and by 2035 it is expected to more than double, growing to 23%. What is interesting is the fact that there is also forecasted even more rapid growth of 'clean meat’ in the world consumption, which is predicted to reach as high as 22% by 2035, surpassing vegan meat alternatives in the following 5 years. By 2040, the consumption of conventional meat is forecasted to account for less than 50% of overall meat consumption. We thus perceive that considerable potential for alternatives to conventional meat has been noted, in particular the potential of 'clean meat’; and in this context, it needs to be noted that while the so-called 'clean meat’ is technically still an animal muscle-based food product, it can offset some of the negative ecological impact of the meat industry as well as offers progress in ensuring the welfare of animals and addresses the ethics of the livestock industry.

Precise details of environmental impact and potential environmental benefits of switching to 'clean meat’ production from the conventional one are still both analysed and calculations and means of large-scale production developed. The development and further analysis are especially needed in terms of carbon dioxide emitted and water used during 'clean meat’ production processes, as those processes consume large quantities of electrical energy (Lynch & Pierrehumbert, 2019). Those processes would result in high climate impact, with majority of the energy produced currently still being carbon-based (IEA, 2023).

Current estimates indicate that by switching to 'clean meat’, greenhouse gasses can be reduced significantly, precisely by 17% when switching to clean chicken, 52% for switching to clean pork, and even as high as 85%–92% for beef (Sinke & Odegard, 2021). To achieve that, a significant number of consumers would have to switch from conventional meat to cultured meat, which is yet to happen (Lynch & Pierrehumbert, 2019). Currently, some modes of 'clean meat’ production result in higher overall global warming impact, especially in more recent calculations, which consider more precise estimates, and calculate not only carbon dioxide emitted, but also nitrous oxide and methane, which have, respectively, 289 and 25 times more intense impact than carbon dioxide, according to the calculations using the GWP100CO2 equivalent (vetsalus.com, 2021).

Although 'clean meat’ is a fairly new food product and topic of research, some studies concerning 'clean meat’ perception and consumer acceptance have already been conducted among consumers from different countries. What is apparent across all the studies is that assessing consumer perception of 'clean meat’ encompasses many areas, such as the degree of weight attached to hedonistic values, emotional attachment towards meat consumption owing to traditional and cultural habits, the perceived importance of meat in diet, aspect of naturalness and perceived artificiality of food, and drive for societal or environmental benefits when making consumer choices (Bryant & Barnett, 2020).

Introducing an alternative of a type of a product already used or a complete novelty on its own ought to evoke positive, but also some level of negative, reaction, as well as an unwillingness to try it, from consumers (Onwezen et al., 2021). Protein alternatives based on plants receive the highest levels of consumer acceptance, due to several factors, but among them the key ones are that they do not evoke disgust or safety concerns, do not seem to be a completely unfamiliar food product, and have health benefits associations (Onwezen et al., 2021). What is important to note is that when compared to different consumer acceptance drivers for different types of meat replacement/alternative protein source, cultured meat and insect meat are being met with the most barriers and preconceived notions (Siddiqui et al., 2022a). Both are met with food neophobia (from consumers in whose cultural background insects are not commonly included in their diets), disgust, and concerns regarding the taste. However, there are also 'positive drivers’, which refer to, for example, connecting 'clean meat’ with positive environmental or social impact.

Methodology

The study was conducted using an online survey placed on the Google Forms platform, and the research tool was a survey questionnaire. The selection of the sample was non-random – the study population consisted of Polish meat consumers, and the research sample consisted of 418 people. The study was conducted from Jan. 24 to Feb. 1, 2022 in Poland. Additionally, the questionnaire included information enabling profiling of respondents in terms of gender, age, education, place of residence, and income. The study conducted was not representative of consumers in Poland, but it may constitute a valuable illustration of the research problem under consideration and an introduction to in-depth representative research. The survey was conducted using a Computer-Assisted Web Interview (CAWI). Analysis of variance (ANOVA) was performed to compare statistically significant differences of the results obtained. To verify the significance of differences between the mean values, Tukey’s test (α = 0.05) were applied using the Statistica 13.3 Computer Software (StatSoft).

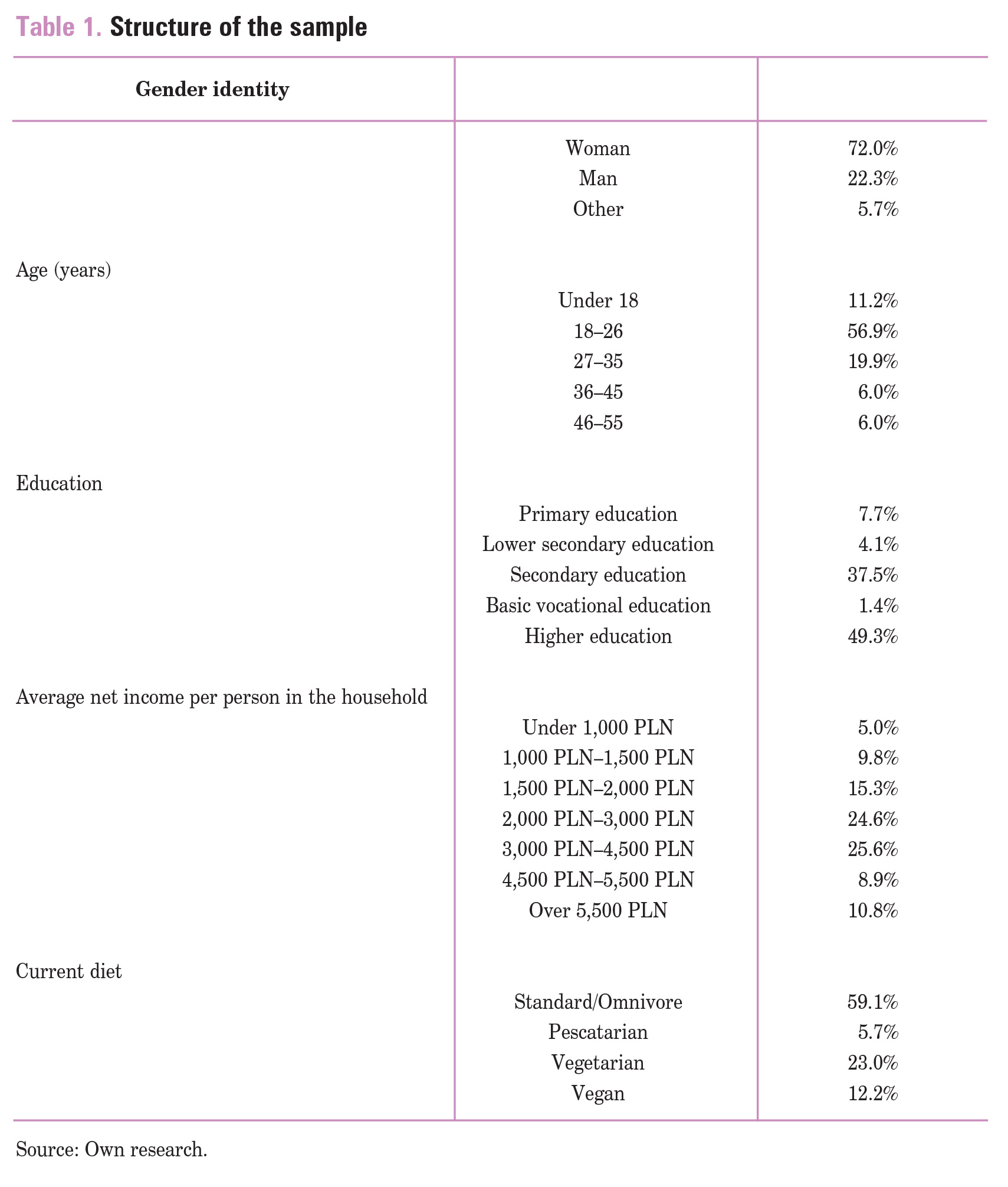

The research sample consisted of 418 respondents with a diverse sociodemographic profile (Table 1).

Most of the group of respondents was comprised of women (72.0%), followed by 22.3% men, and 5.7% of respondents outside the gender binary or not wishing to indicate their gender identity. Over a half of the respondents belonged to the 18–26 year age group (56.9%) and almost 20% belonged to the 27–35 year age group. What is worth noting is that close to a half of the respondents declared having higher education (49.3%). In terms of the income of respondents, there was a quite-good representation of a majority of the income brackets, with the biggest percentage of the respondents belonging to the categories of 2,000–3,000 PLN (24.6%) and 3,000–4,500 PLN (25.6%) income per person in a household group. Respondents represented also varied dietary preferences, with a majority of them consuming meat (64.8%), either on a standard/omnivorous diet (59.1%) or a pescatarian diet (5.7%), and 35.2% of them following diets excluding meat, precisely 23.0% following a vegetarian diet and 12.2% following a vegan diet.

Results

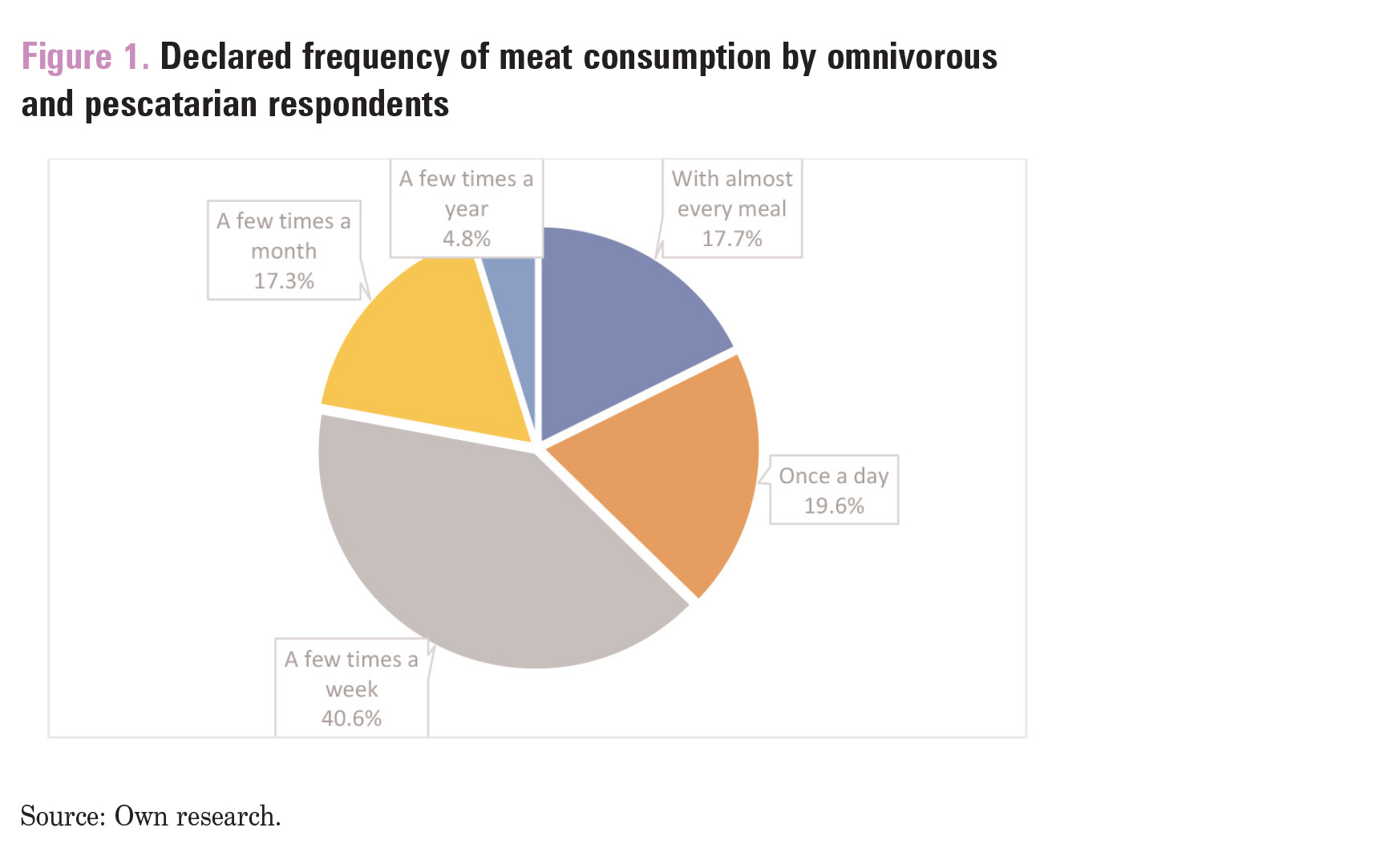

Firstly, in a section dedicated to respondents who declared following a diet that includes meat (omnivores and pescatarians), the significance of meat in a diet was surveyed. According to the collected answers, meat was given a medium score by respondents in terms of importance in a diet, averaging 3.9 on a 7-point scale. Men assigned notably higher importance of meat in the diet (4.5) than women (3.9) and respondents outside the binary gender divide (3.6). The declared frequency of meat consumption is most often a few times per week (40.6%), and then it is followed by very similar scores for three categories, namely: once daily (19.6%), with almost every meal (18.0%), and a few times a month. These results differ from the results obtained in CBOS’s survey (2019), where once-daily consumption was declared by 33% of all respondents and a few times per week was declared by 52% of all respondents. The biggest difference appears to be that the declared consumers’ meat consumption. In this survey the declared consumption is of higher frequency, as multiple times a day consumption is close to 18% (Fig. 1.), while in the CBOS survey it was only 3% for this frequency.

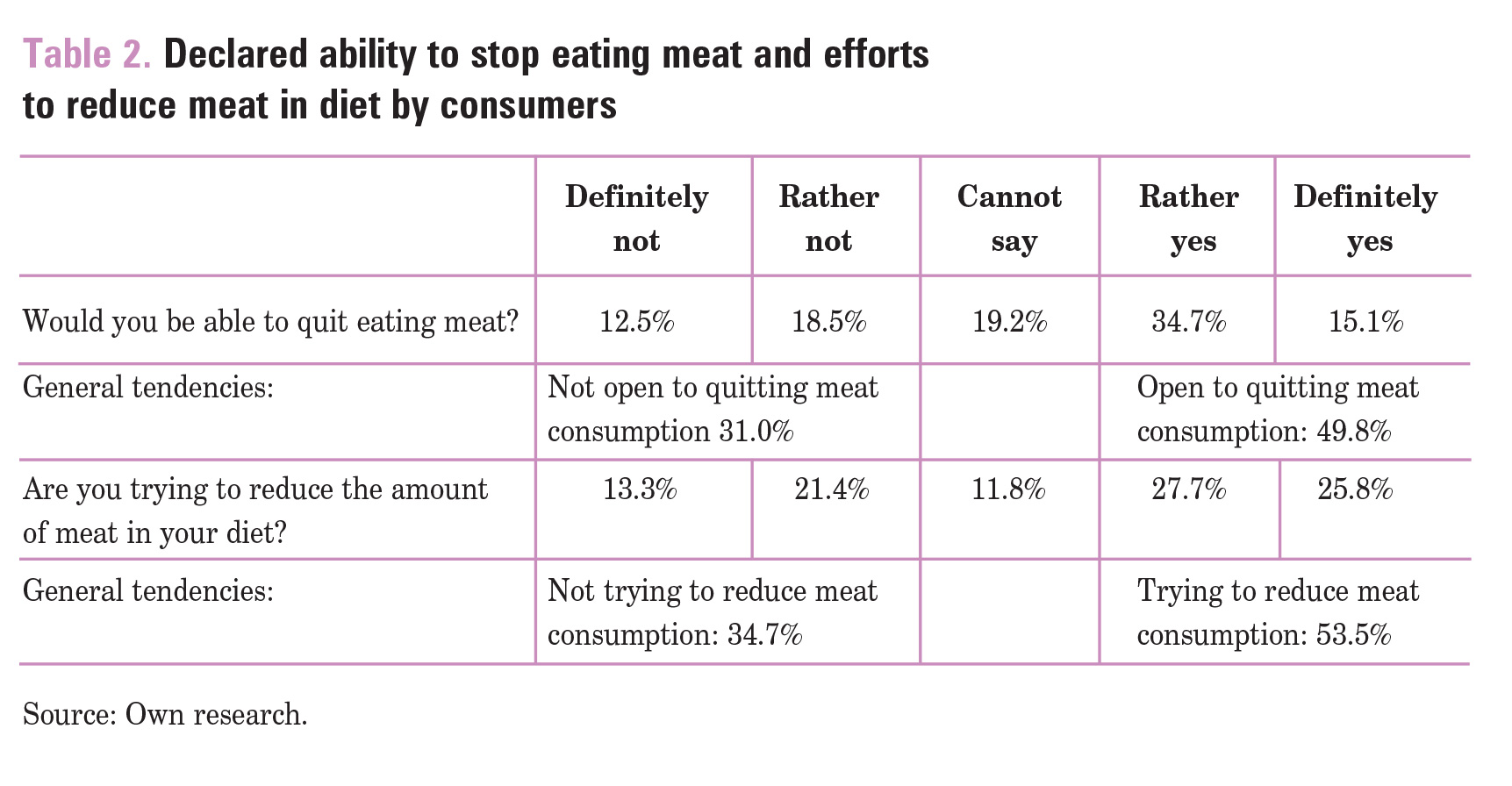

Respondents’ willingness to reduce eating meat and to stop eating meat were similar, with slightly higher percentage of declarations of reducing meat consumption (53.5%) than declared ability to quit eating meat (49.8%) (Table 2). It is worth noting that 7.4% more respondents were undecided or not sure that they would be able to quit eating meat (19.2%) than people who say that they try to limit their meat consumption (11.8%). This comparison indicates that the interviewees are rather open to adjusting than completely changing their diets, especially given that the reduction question gathered over 10% more of the 'Definitely yes’ declarations.

A growing trend among Polish consumers, especially the younger population, is seeking to reduce or completely eliminate meat from their diets. A 2021 survey of a research sample of 1,300 people aged 15–29 years found that almost half of the respondents (44%) claim that they have limited their meat consumption, including in this number 8% of people already on a vegetarian or vegan diet (HBF, ISD, 2022).

In the following questionnaires section, applied for all respondents, knowledge, openness, barriers, and motivations regarding 'clean meat’ were assessed. When asked if they know what 'clean meat’ is, only a little over 25% of respondents confirmed that they do know what it is, with the rest of the respondents saying no (39.5%) or that they are not sure (35.4%).

Surprisingly, although 'clean meat’ is an animal product, almost 50% of the vegan respondents (49.0%) knew about it, while only 19.8% omnivores and pescatarian respondents declared knowledge of the subject. Other groups with some of the highest scores in terms of the knowledge about the product were respondents who earned 4,500–5,500 PLN (40.5%) and above 5,500 PLN (40.0%), those not identifying on the gender binary (37.5%), respondents scoring the highest on openness to trying 'clean meat’ (36.9%) and other new foods (34.3%), and people in the 27–35 years age range (32.5%). Comparing these results to Pachołek and Popek’s survey (2021), which also aimed at establishing Polish consumers’ knowledge and attitude towards clean meat, it was established that respondents who did not eat meat (50.5%), identified as women (41.8%), and had higher education (50.5%) were more likely to declare that they know what in-vitro meat is and correctly identify it, with over 33% of respondents overall claiming knowledge of the product. The results of this survey also show a higher declared knowledge of the product by people with higher education (28.6%), while in terms of gender, women scored lower than men and respondents outside the gender binary, with respective declared knowledge scores of 20.6%, 36.6%, and 37.5%.

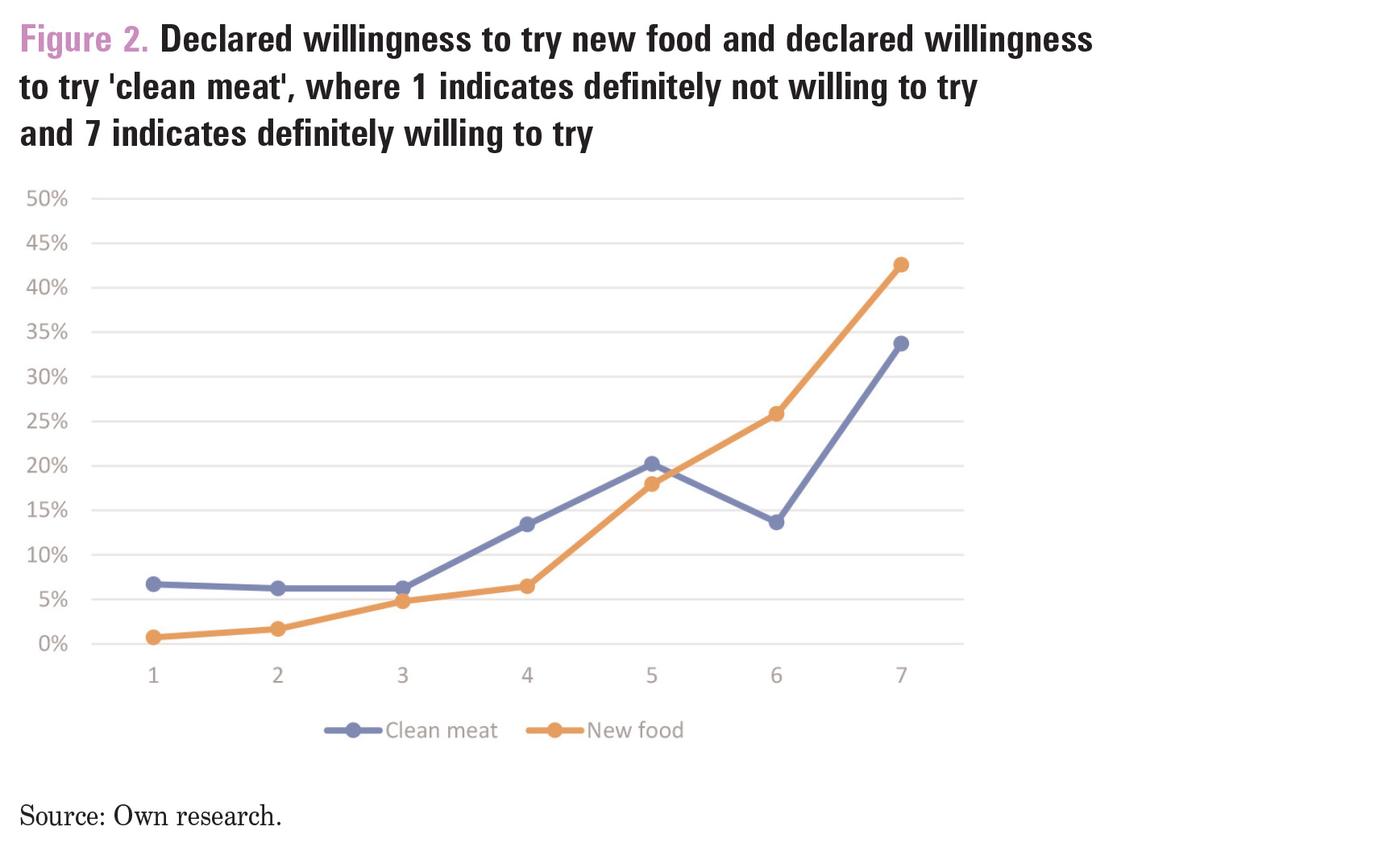

Despite low awareness of the product, a majority declared being open to trying it (Figure 2). Vegans and vegetarians scored the lowest on the 7–point scale of openness to trying 'clean meat’, scoring, respectively, 4.3 and 4.8, while people on a pescatarian diet scored the highest, 5.9, and standard diet averaging 5.3. Notably, among respondents who marked their openness as 7 (33.7%), as high as 36.9% of them knew what 'clean meat’ was, as opposed to groups who ranked their openness to trying meat lower than 7, who had lower percentage of awareness of 'clean meat’. Respondents who ranked their openness as 1 also had the lowest awareness of the product (10.7%). Scores between 1 and 7 had more similar results, ranging from 17.5% awareness for openness ranked as 6, to 26.9% for openness marked as 3. This can be attributed to the higher 'clean meat’ acceptance that is observed to prevail when there is already a familiarity in the mind of the potential consumer concerning this product, or when additional information pertaining to the product is brought to the potential consumer’s attention; these are phenomena that have been found to improve openness to trying 'clean meat’, although it has not been possible to find an association between the prevalence of this openness and any specific type of communication. The importance of consumer familiarity, which is considered as one of the keys, if not the key element, to gaining consumer acceptance of 'clean meat’, was stressed by quite a few studies, albeit with reservations. Some information, the same as framing, can deteriorate consumers’ acceptance of 'clean meat’ despite the rule being that any information is better than no information (Bryant & Dillard, 2019). What is worth noting is that people who declared the most definite unwillingness to quit eating meat were less open to trying 'clean meat’ (4.3) than people following a diet excluding meat (4.6).

Polish consumers’ willingness to try 'clean meat’, as reported in Popek and Pachołek’s study (2021), was as high as 56.1% for all respondents, with a slightly higher openness among men (62.5%), and it was higher for those in age categories from 12 years to 30 years, as well as nearly 20% higher for those who eat meat than respondents on meat-free diets. The group presenting a significantly higher willingness to try cultured meat is respondents from cities with more than 250,000 residents.

Additionally, for respondents following a diet that includes animal products, three questions were asked to roughly evaluate respondents’ awareness concerning alternatives to conventional meat, their degree of environmental awareness, or care for the environment, as assessed based on their choice of products regarded to be environmentally friendly, and their care for animal welfare. These questions referred to buying organic meat, paying attention to the class of eggs bought, and whether it is important to the respondents that the products they buy be marked as 'eco’ or 'bio’. A majority of respondents answered that they always (61.1%) pay attention to the type of eggs bought, with only 3.5% answering that they never do that. Respondents claiming that they always pay attention to the type of eggs bought also expressed a noticeably more positive attitude towards 'clean meat’ than those who do it less frequently. Buying organic meat was a much rarer practice among the participants of the survey, with only 3.0% of them answering they always do it and 12.9% that they usually do it, while as much as 20.3% of respondents said that they never buy organic meat.

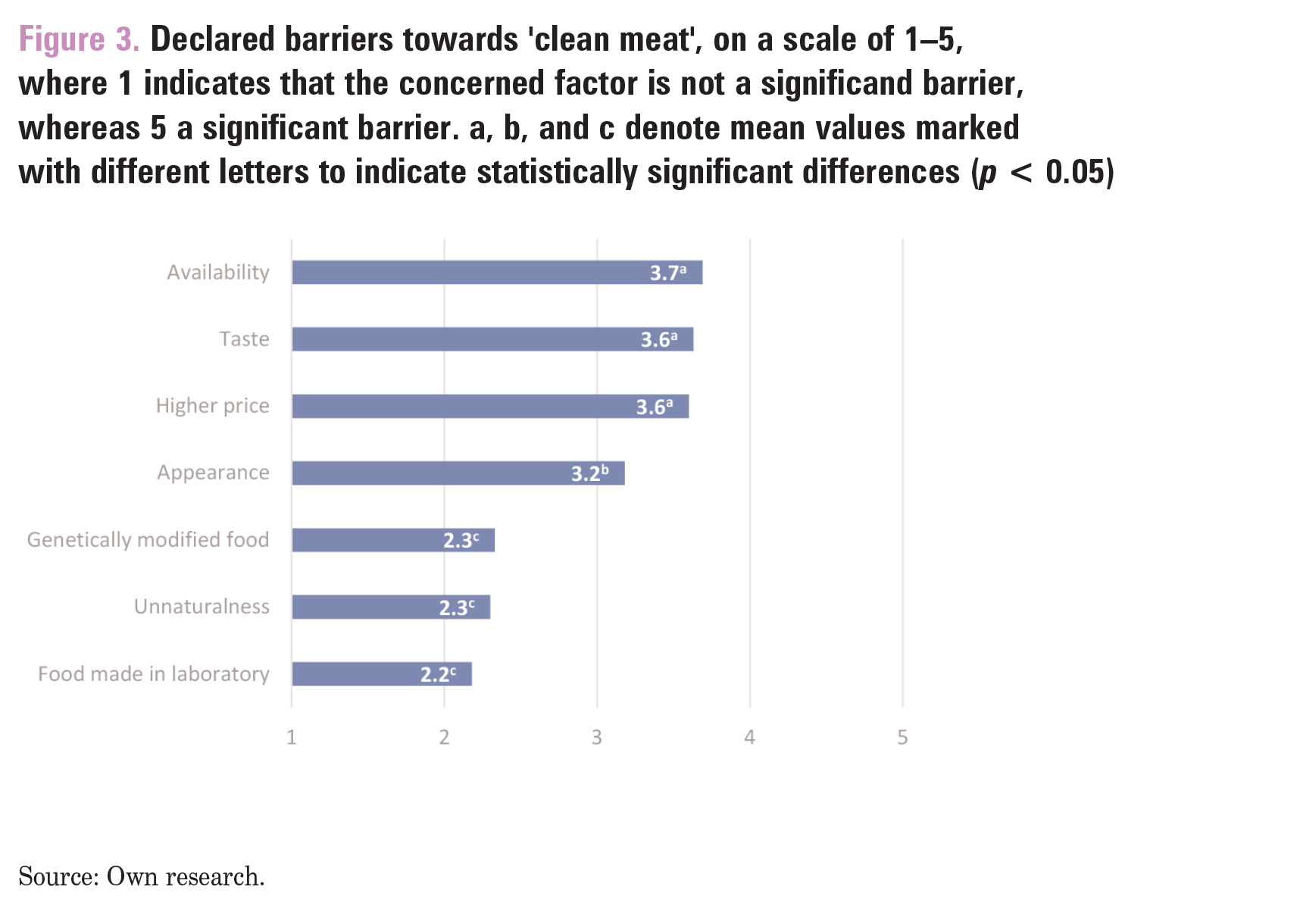

In light of the research, several factors have been identified as both motivations and barriers when it comes to being open to trying 'clean meat’ and choosing food for consumption in general. Those barriers are (Figure 3): food made in laboratory, taste, appearance, unnaturalness, being a genetically modified food, higher price, and availability. Results show that on average, the biggest barriers for potential consumers to overcome, which scored on the higher end of the 5-point scale, are: availability (3.7), taste (3.6), higher price (3.6), and appearance (3.2). Polish consumers seem to not be overly discouraged by the origin of the 'clean meat’, which can be perceived as unnatural, since it was produced in a laboratory, not an animal farm and slaughterhouse, and this is in conformity with the results observed in other studies, which indicated consumers’ reluctance or complete unwillingness to try 'clean meat’ when it is connected to or framed with the technological aspects of production and the perceived unnaturalness (Bryant & Dillard, 2019). For 'clean meat’, providing too much information or focusing too much on the technical aspects and the production process can evoke disgust, confusion, and distrust, which leads to a lowering of the overall consumer acceptance and willingness to try product (Bekker et al., 2017; Bryant & Dillard, 2019, Mancini & Antonioli, 2019).

The youngest and the oldest groups among the respondents obtained the highest combined score of factors that constitute barriers to trying 'clean meat’. The reasons for such results can be two-fold: (i) as individuals age, it becomes increasingly difficult for them to change their opinions about food and dietary habits (Grasso et al., 2019); and (ii) among the respondents, young consumers who had finished only primary or lower secondary education were a major constituent, and these are the same individuals, who, as groups, expressed a less positive view of 'clean meat’ in comparison with the views of the secondary and higher education groups.

For respondents who indicated the lowest openness to trying 'clean meat’ (6.7%), the major barriers were price (4.0), availability (3.9), taste (3.9), and appearance (3.9). They also scored the highest average in terms of all barrier categories combined (3.6), which creates a consistent picture of how respondents perceive the innovation in question. Other groups that expressed high barriers were interviewees following an omnivorous diet (3.2), valuing meat highly in diet (3.4–3.3), not interested in reducing their meat consumption (3.4–3.3), and never (3.5) or only sometimes (3.4) paying attention to the type of eggs bought.

What characterises today’s consumers in Poland is how highly they value the aspect of taste when choosing a product (EFSA, 2022). Cost influences food choices the most in most countries in the European Union but in Poland taste and cost of food are valued equally. Ethics and beliefs are becoming noticeably more important as a factor driving foodpurchasing decisions for Polish consumers, rising by 7 percentage points from 2019 to 2022 (EFSA, 2022). An overwhelming majority of consumers claim that they care about the welfare of the animals in the context of animal husbandry. Polish respondents scored 36%, the highest in the EU, with regard to concern about dangers associated with additives in food, with no or virtually zero worries regarding problems with farming (0%), product information (1%), production (2%), packaging (0%), origin (1%), environmental impact (1%), ethics (2%), nutritional value (2%), and genetically modified organisms (2%). Polish respondents expressed relatively high concern about risks associated with health impact (9%), quality and shelf life (7%), and the price of the food (8%); and low concern with risks associated with food being natural, organic, or artificial (3%). What is important to note is that a complete lack of worry was expressed by only 9% of respondents (EFSA, 2022, p. 110). Poland scored the lowest on the topic of personal interest in food safety, with only 33% being involved in the topic, 70% being the EU average.

As for results of the associations of meat with nine categories of either positive or negative descriptors, the overall perception of the 'clean meat’ by respondents is rather positive (Figure 4). A category in which 'clean meat’ scored the lowest was naturalness, though as a barrier it was scored as second lowest. Therefore, although the in-vitro meat is not being seen as very natural, it does not repulse potential consumers.

On average, the greater the importance that was assigned by a respondent to meat in their diet, the less positive associations they had with 'clean meat’. This correlation could be observed through the averages of all categories when scoring associations with 'clean meat’. The less important meat was in a respondent’s diet, the more positive associations were for 'clean meat’. Furthermore, people following diets that exclude meat, in general, had a more favourable overall perception of 'clean meat’, albeit with one notable exception: namely, a category in which people who don’t eat meat had a significantly worse view of 'clean meat’ than people who eat meat, with this category of people being of the view of 'clean meat’ being disgusting as opposed to appetising.

In terms of differences between respondents from different income brackets, no correlation can be noticed other than respondents who have monthly income per person in a household lower than 1,000 PLN having a less positive view of 'clean meat’ (5.0) than those from other income brackets.

In terms of declared factors, which would encourage interviewees to try 'clean meat’, the most often-given answers were ecological benefits (21.1%), good taste (16.4%), and attractive price (16.2%). Less popular answers were connected to safety (12.5%) and health reasons, such as good nutritional value (11.5%) and health benefits (11.2%). These inferences indicate a variation from the survey conducted by Gomez-Luciano et al. (2019), where aspects of health, safety, and the nutritional content were major factors constituting the motivators to pay for 'clean meat’. The results reported by Popek and Pachołek (2021) also stressed the importance of ecological benefits being seen as a primary advantage by respondents, as well as ethical and animal welfare concerns connected with limiting the number of animals used for breeding for animal products and the possibility of securing a more sustainable and affordable meat source.

On the other hand, the motivators and barriers mentioned in the 2022 alternative proteins consumer acceptance review largely overlap, where the major consumer acceptance drivers for cultured meat were taste, environmental impact, food neophobia, and disgust (Siddiqui et al., 2022a).

There have been several studies and surveys, performed in quite a few countries, with the aim of establishing the drivers of, and accordingly ascertaining the factors directly or indirectly influencing, the attitude towards 'clean meat’ and the openness to try it. The surveys performed in countries such as Poland, China, Netherlands, and Spain allowed the identification of the demographical factors needing to be considered when preparing a social or marketing strategy aimed at improving consumer perception and acceptance of 'clean meat’. General drivers of higher consumer acceptance and willingness to try 'clean meat’ are (in no particular order):

1. Liberal political affiliation

2. Living in urban areas

3. Receiving education /being informed on the topic of 'clean meat’

4. Higher income

5. Familiarity with 'clean meat’, awareness of 'clean meat’

6. Young age

7. Identifying as a man/male

8. Ethical priorities

9. Nutritional priorities

10. Getting informed on the topic of 'clean meat’.

The opposite of qualities or affiliations mentioned above may lower the likelihood of positive attitude towards 'clean meat’ (Siddiqui et al., 2022b). The political affiliation was not a factor considered in this survey, although some of the factors overlap. Participants who were familiar with 'clean meat’ prior to taking part in the survey expressed a more positive attitude towards 'clean meat’, and the same tendency applied to younger participants, and those with higher income brackets. However, in terms of differences between groups of respondents created based on sociodemographic characteristics, differences were, in most cases, quite slight and did not indicate noticeable regularities, such as the differences between groups based on consumer preferences and values.

The purposive selection of respondents used in the study (Internet users) means that the results and conclusions obtained do not provide a basis for generalisation to the entire population. However, they do make an interesting contribution to further research.

Conclusions

'Clean meat’ offers potential benefits in terms of lessening some of the environmental impact of meat production, increase in global availability of safe protein source, and more humane approach in obtaining animal tissue for consumption as well as improving working conditions of people involved in the conventional meat production processes. However, before introducing 'clean meat’ to consumers, concerns pertaining to, as well as the prevailing negative perception of, 'clean meat’ expressed by some of the consumers have to be addressed. In general, a majority of respondents are not aware of the concept of the 'clean meat’, but despite limited awareness of the concept, a majority are still expressing being open to trying it. The biggest barriers that could discourage people from trying 'clean meat’, as pointed out by respondents, are of a practical and hedonistic nature, rather than a negative perception of clean meat as a novelty food product created in a laboratory. Limited or non-existent prior knowledge of this food alternative did not cause respondents to have negative perception of 'clean meat’. In fact, it scored upper-half ratings for every category of a given negative to positive spectrum, even for naturalness and appetising aspects. Connecting the survey results with the fact that a large number of Polish consumers value meat highly in their diets (CBOS, 2019), some of them wanting neither to quit nor reduce eating it, 'clean meat’ can present a compromise in terms of not changing the diet but rather changing the meat industry. The future of 'clean meat’ as a product seems to depend principally on the aspects connected with this product’s development, and the rigorous adoption of such development will result in a clear, definite difference for the environment as well as the emergence and flourishing of a market offering an attractive and easily available protein product, at least in comparison with conventional meat.

The results of this survey were largely consistent with the general trends, such as the ones reported by EFSA (2022), showing that the two determining factors for Polish consumers in terms of food choices are taste and price, which are then followed by environmental and animal welfare concerns, the last two among which are characterised by a growing awareness about them among the Polish public; and that aspects of naturalness or artificiality of food are not of the utmost importance. Some of the factors that correlated with the most positive attitude towards 'clean meat’ were eating meat but not considering it as an important part of the diet, limiting meat consumption, having prior knowledge of the topic, following a pescatarian diet, identifying outside the gender binary, scoring low on food neophobia, and belonging to the 27–35 years age range. Factors that correlated with the least positive factors towards 'clean meat’ were declared unwillingness to quit eating meat, following a vegan diet, and income below 1,000 PLN per person in a household.

During the analysis of the answers provided, it was possible to establish more trends and correlations between consumer attitudes and the characteristics of preferred products, and ascertain what motives guide the respondents in their nutrition decisions in the context of the sociodemographic data defining them. Therefore, it would be worthwhile for further research to explore differences in attitudes towards cultured meat and other protein alternatives as the focus vs. values prioritised by consumers in food products, as well as priorities and barriers to dietary decision-making, and the most important motivators for making changes in eating habits. Additionally, the differences in the motivations of Polish consumers can be attributed to the diversity-as ascertained from the general indicators used in the present research-characterising the drivers for 'clean meat’ and other alternative sources of protein, such as Polish consumers not valuing very highly the aspect of naturalness, not being overly concerned with the safety of food products, and-probably most significantly-being able to express a positive attitude about a food product they have little knowledge about.

References

1. Bakaloudi, D. R., Halloran, A., Rippin, H. L., Oikonomidou, A. C., Dardavesis, T. I., Williams, J., Wickramasinghe, K., Breda, J., & Chourdakis, M. (2021). Intake and adequacy of the vegan diet. A systematic review of the evidence. Article in Clinical Nutrition, 40(5), 3503–3521. https://doi.org/10.1016/j.clnu.2020.11.035

2. Bekker, G. A., Fischer, A. R. H., Tobi, H., & van Trijp, H. C. M. (2017). Explicit and implicit attitude toward an emerging food technology: The case of cultured meat. Appetite, 108, 245–254. https://doi.org/10.1016/j.appet.2016.10.002

3. Bryant, C., & Barnett, J. (2020). Consumer acceptance of cultured meat: An updated review (2018–2020). Applied Sciences, 10(15), 5201. https://doi.org/10.3390/app10155201.

4. Bryant, C., & Dillard, C. (2019). The impact of framing on acceptance of cultured meat. Frontiers in Nutrition, 6, 103. https://doi.org/10.3389/fnut.2019.00103

5. CBOS. (2019). Jak zdrowo odżywiają się Polacy. Retrieved January 4, 2023, From https://www.cbos.pl/SPISKOM.POL/2019/K_106_19.PDF

6. Chirki, S., Ellies-Oury, M. P., & Hocquette, J. F. (2022). Is cultured meat a viable alternative to slaughtering animals and a good compromise between animal welfare and human expectations? Animal Frontiers, 12(1), 35–42. https://doi.org/10.1093/af/vfac002

7. EFSA. (2022). Special Eurobarometer – March 2022, „Food safety in the EU”, Report. Retrieved January 6, 2023, From https://doi.org/10.2805/729388

8. eu.boell.org. (2021). Companies: Dominating the market from farm to display case. Retrieved on January 19, 2023, From https://eu.boell.org/en/2021/09/07/companiesdominatingmarket-farm-display-case

9. Godfray, H. C. J., Aveyard, P., Garnett, T., Hall, J. W., Key, T. J., Lorimer, J., Pierrehumbert, R. T., Scarborough, P., Springmann, M., & Jebb, S. A. (2018). Meat consumption, health, and the environment. Science, 361(6399), eaam5324. http://dx.doi.

org/10.1126/ science.aam5324

10. Gómez-Luciano, C. A., de Aguiar, L. K., Vriesekoop, F., & Urbano, B. (2019). Consumers’ willingness to purchase three alternatives to meat proteins in the United Kingdom, Spain, Brazil and the Dominican Republic. Food Quality and Preference, 78(2019), 103732. https://doi.org/10.1016/j.foodqual.2019.103732

11. govgrant.co.uk. (2023). How well is Europe playing the cultured meat game? What the numbers tell us. Retrieved April 17, 2023

12. Grasso, A. C., Hung, Y., Olthof, M. R., Verbeke, W., & Brouwer, I. A. (2019). Older consumers’ readiness to accept alternative, more sustainable protein sources in the European Union. Nutrients, 11(8), 1904. https://doi.org/10.3390/nu11081904.

13. Heinrich Böll Foundation in Warsaw, The Institute for Sustainable Development (ISD). (2022). „Atlas Mięsa. Fakty I dane na temat zwierząt, które zjadamy”. Retrieved January 08, 2022, From https://pl.boell.org/sites/default/files/2022-02/Atlas%20mi%C4%99sa.pdf 14. IEA (International Energy Agency). (2023). Electricity Market Report 2023.

15. Klurfeld, D. M. (2015). Research gaps in evaluating the relationship of meat and health. Meat science, Vol. 109, 86–95. https://doi.org/10.1016/j.meatsci.2015.05.022

16. Lynch, J., & Pierrehumbert, R. (2019). Climate impacts of cultured meat and beef cattle. Frontiers in Sustainable Food Systems, Vol.3, Art.5 doi: https://doi.org/10.3389/ fsufs.2019.00005

17. Mancini, M. C., & Antonioli, F. (2019). Exploring consumers’ attitude towards cultured meat in Italy. Meat Science, Vol. 150, 101–110. https://doi.org/10.1016/j.meatsci.2018.12.014

18. Michail, N. (2021). New growth medium supplement for “clean meat.” figlobal.com. https://insights.figlobal.com/startups/new-growth-medium-supplement-clean-meat

19. OECD, FAO. (2020). OECD-FAO Agricultural Outlook 2020–2029. Retrieved January 11, 2023, OECD-FAO Agricultural Outlook 2020–2029.

20. Onwezen, M. C., Bouwman, E. P., Reinders, M. J., & Dagevos, H. (2021). A systematic review on consumer acceptance of alternative proteins: Pulses, algae, insects, plant–based meat alternatives, and cultured meat. Appetite, 159, 105058.

https://doi.org/10.1016/j.appet.2020.105058

21. Popek, S., & Pachołek, B. (2021). A survey on Polish consumers’ perceptions of meat produced from stem cells in vitro. Marketing of Scientific and Research Organizations, 42(4), 61–74. https://doi.org/10.2478/minib-2021-0021.

22. Sans, P., & Combris, P. (2015). World meat consumption patterns: An overview of the last fifty years (1961–2011). Meat Science, Vol. 109, 106–111. https://doi.org/ 10.1016/j.meatsci.2015.05.012. Erratum in: Meat Sci, (2016). Vol. 114, 154.

23. sciencefocus.com. (2022). What is lab-grown meat? How it’s made, environmental impact and more. Retrieved April 3, 2023, from https://www.sciencefocus.com/science/what-islabgrown-meat-a-scientist-explains-the-taste-production-and-safety-of-artificial-foods/

24. Siddiqui, S. A., Khan, S., Murid, M., Asif, Z. Oboturova, N. P., Nagdalian, A. A., Blinov, A. V., Ibrahim, S. A., & Jafari, S. M. (2022a). Marketing strategies for cultured meat: A review. Applied Sciences, 12(17), 8795. https://doi.org/10.3390/app12178795

25. Siddiqui, S. A., Alvi, T., Sameen, A., Khan, S., Blinov, A. V., Nagdalian, A. A., Mehizadeh, M., Adli, D. N., & Onwezen, M., (2022b) Consumer acceptance of alternative proteins: A systematic review of current alternative protein sources and interventions adapted to increase their acceptability. Sustainability, 14(22), 15370. https://doi.org/10.3390/ su142215370

26. Sinke, P., & Odegard, I. (2021). LCA of cultivated meat. Retrieved February 26, 2023, From https://cedelft.eu/wp-content/uploads/sites/2/2021/04/CE_Delft_190107_LCA_of_ cultivated_meat_Def.pdf

27. Srutee, R., Sowmya, R. S., Annapure, U. S. (2021). Clean meat: Techniques for meat production and its upcoming challenges. Animal Biotechnology, 33(7), 1721–1729.

https://doi.org/10.1080/10495398.2021.1911810

28. Vermeir, I., Weijters, B., De Houwer, J., Geuens, M., Slabbinck, H., Spruyt, A., Van Kerckhove, A., Van Lippevelde, W., De Steur, H., & Verbeke, W. (2020). Environmentally sustainable food consumption: A review and research agenda from a goal-directed perspective. Frontiers in Psychology, Vol. 11, 1603.

29. vetsalus.com. (2021). Briefing: Some basic facts about methane. Retrieved January 12, 2023, From https://vetsalus.com/news/2021/11/vetsalus-briefing-some-basic-facts-aboutmethane

30. Wood, J. D. (2023). Meat composition and nutritional value. In F. Toldra (Ed.), Lawrie’s Meat Science. 9th edition. (pp. 666–685). Woodhead Publishing Limited.

Marta Łyko — A graduate of the University of Economics and Business in Poznan, her research interests encompass consumer attitudes towards the development of plant-based foods and animal product substitutes, as well as the use of persuasion, manipulation and social engineering techniques in marketing and business structures.

Bogdan Pachołek — An assistant professor at the University of Economics and Business in Poznan, he is employed at the Product Marketing Department of the Marketing Institute. His research and teaching interests focus on consumer behaviour, design and development of food innovations, and product management.

Magdalena Ankiel — A professor at the Poznań University of Economics and Business, she is employed at the Product Marketing Department at the Institute of Marketing. Her research and teaching interests pertain to the areas of consumer behaviour, innovation design and development, and informational value of packages. She is an author of several scientific papers and books. She has experience in product management and packaging innovation projects implemented for companies.