- eISSN 2353-8414

- Phone.: +48 22 846 00 11 ext. 249

- E-mail: minib@ilot.lukasiewicz.gov.pl

Price differentiation in online and offline retail: an empirical study of current practices

Ewa E. Kiczmachowska1*, Paweł de Pourbaix2, Dariusz Jemielniak3

Kozminski University, Jagiellońska 57 Street, 03-301 Warszawa

1E-mail: ekiczmachowska@kozminski.edu.pl

ORCID: 0000-0002-7336-875X

2E-mail: paweldep@kozminski.edu.pl

ORCID: 0000-0002-0300-8716

3E-mail: darekj@kozminski.edu.pl

ORCID: 0000-0002-3745-7931

DOI: 10.2478/minib-2023-0007

Abstract:

The purpose of this article is to present the practice of price differentiation in multichannel sales conditions. The study reviews the literature on channel pricing policy. The authors set a goal to study the practices of retailers operating in online and offline channels in Poland in terms of price differentiation between channels. Using the example of the EMPIK and SMYK chains, price differences between online and offline channels were analysed for several 100 products in key categories for these retailers. The prices were obtained by scraping the data from the websites of both retailers in November 2022. Statistical analysis was designed to examine differences in pricing by product category, position on the “most frequently purchased” list and price range. This research confirmed previous results that online vs. offline price differentiation was not widely used by leading multichannel retailers in the most popular categories bought online: only two out of 12 retailers elicited for the study were found to perform it. It also confirmed previous findings that if price differentiation was applied, the items were cheaper online more often. However, the average depth of discount was considerably higher. Apart from these general findings, our research delivered detailed insights at the category level as the depth of discount and the share of products sold at a discount online considerably differed between categories with comparable and non-comparable offers. Additionally, this study provided a unique analysis of the multichannel price differentiation strategy in relation to popularity or the absolute price of the product. While in the case of the popularity of the product, the offer uniqueness seemed to play a role, the relation to the absolute price of the product showed a mixed picture and would need further investigation.

MINIB, 2023, Vol. 48, Issue 2

DOI: 10.2478/minib-2023-0007

P. 1-16

Published June 31, 2023

Price differentiation in online and offline retail: an empirical study of current practices

Introduction

The percentage of consumers buying online increased sharply between 2018 and 2022, from 56% to 77% of Internet users in Poland (Gemius Polska, 2018; Gemius Polska, 2022). This phenomenon can be explained by the COVID-19 pandemic and lockdowns, which had an immense impact on online buying behaviours (Gemius Polska, 2022). According to the report by Strategy& (part of PwC network, 2022), the value of the e-commerce market in Poland increased from 48bn PLN in 2018 to 92bn PLN in 2021 and is estimated to reach 187bn PLN in 2027 (Strategy& — PwC, 2022). E-commerce has been also steadily increasing its share in the retail market from 8% in 2018 to 12.9% in 2021 and is estimated to reach 17% in 2027 (Strategy& — PwC, 2022).

Price remains the most crucial factor when shopping online and is more important than when shopping offline: depending on the category, 56% to 63% of the respondents pointed price as the most critical factor when buying online, while 43% to 55% of the respondents regarded price as the most important factor when purchasing offline (YourCX, 2021).

Over time, offline retailers facing competition from online retailers realised that one way to respond to this threat is to add their own online channels and take advantage of the potential synergies between the two channels. This ongoing transition of many retailers from pure-play (i.e. offline-only or online-only) to multichannel retailing gave rise to many strategic questions (Ratchford, Soysal, Zentner, & Gauri, 2022).

One main advantage of the online compared to the offline channel is lower distribution costs. This advantage stems from the ability to store products online in a few remote warehouses vs. the need to store products offline in several (often hundreds of) physical stores. Physical stores have shelf and storage space limitations and need to be situated conveniently to customers, and hence are associated with much higher overall real estate costs than remote warehouses (Ratchford et al., 2022). Moreover, offline formats have an advantage in offering the services of personal inspection and immediate delivery, while online channels eliminate travel time and geographic constraints and may be able to provide more extensive assortments at a lower cost to the retailer (Betancourt, Chocarro, Cortinas, Elorz, & Mugica, 2016).

Given the fast development of online retail, the price being the most critical factor when buying online and cost and value to customer characteristics of online and offline, the usage of price differentiation strategy by retailers becomes one of the priorities for research in digital marketing (Kannan & Li, 2017). Although the differentiation strategy might seem tempting, researchers have expressed doubts about whether companies can ‘actually charge different prices for the same item in different channels’ (Neslin & Shankar, 2009, p. 79) because ‘consumers may perceive inconsistent prices offline and online [as] unfair’ (Li, Gordon, & Netzer, 2018, p. 828).

Following a Framework for Multichannel Customer Management (Neslin et al., 2006), we add to the research in the area of coordinating channel strategies, specifically on the issue of coordinating the prices across channels. With two empirical studies, we aim to answer the following questions: (RQ1) do multichannel retailers engage in price differentiation between online and offline channels, and if so, (RQ2) what strategies do they involve in relation to product category, product absolute price and the product popularity.

This article is organised as follows: Section 2 describes the existing literature on channel-based price differentiation in retail; Section 3 outlines methodology; Section 4 is dedicated to results and discussions of Study 1. and 2. responding to RQ1 and RQ2, respectively; and Section 5 covers conclusions, limitations and recommendations for future research.

Literature Review

The existing literature on the interaction of online and offline channels in a multichannel retailer mainly focused on the effect of adding one channel to an existing other channel. The main conclusion from this stream of research is that the online channel does not necessarily significantly cannibalise or threaten the survival of the offline channel (Ratchford et al., 2022).

When it comes to channel-based price differentiation, before going any further, price differentiation (or discrimination) and price dispersion should be distinguished. While the former is done by the same retailer or manufacturer, the latter is a result of different pricing by different competing companies (Reinartz, Haucap, Wiegand, & Hunold, 2017).

Channel-based price differentiation has been mainly researched from three perspectives: theoretical research assessing optimal retailer behaviour, observational research studying how retailers behave today and empirical research exploring consumer behaviour towards practices of channel-based price differentiation (for literature review, refer to Fassnacht & Unterhuber, 2015).

The latest research on pricing in a multichannel environment covers the cross-channel effects of price promotions on category purchase decisions for multichannel grocery retailers (Breugelmans & Campo, 2016), the role of competitive forces in geographic pricing decisions (Li et al., 2018), price differentiation related to shipping options (Hammami, Asgari, Frein, & Nouira, 2022) or retailers’ adoption (or non-adoption) of self-matching across a range of competitive scenarios (Kireyev, Kumar, & Ofek, 2017).

Customers’ perception of fairness in channel-based price differentiation remains an important research topic. Bondos (2016) analysed image consequences that might lead to unfavourable consumer purchasing behaviour changes. Further research concentrated on price (un)fairness perceptions in personalised pricing (Richards, Liaukonyte, & Streletskaya, 2016; Hufnagel, Schwaiger, & Weritz, 2022) or regarding pay-what-you-want (PWYW) induced price discrimination across channels (Narwal & Nayak, 2020).

On the other hand, research shows that price differentiation might not necessarily evoke negative perceptions among customers. Fassnacht and Unterhuber (2016) concluded that price differentiation with lower online prices was quite well accepted by consumers and that providing a rationale for a price difference between the online and offline channel by communicating information on the difference in costs between the channels could have a positive impact on fairness perception. Homburg, Lauer, and Vomberg (2019), who studied consumers’ attitudes toward channel price differentiation, found that offline premiums are particularly feasible for high-priced products and low-priced take-away products.

Despite the possible customers’ acceptance of particular price differentiation strategies, research shows that this strategy is not widely used among retailers. Price dispersion analysis on the U.S. market suggested that retail managers may plausibly consider price discrimination across stores to be infeasible (Hitsch, Hortaçsu, & Lin, 2021). Wolk and Ebling (2010) found that retailers still applied a consistent price strategy for the majority of their products (77.45% and 65.7% in 2 studies), given price differentiation, the majority (73.42% and 62.98% in 2 studies) of products were offered at higher offline prices. Similarly, Cavallo (2017) reported that in large, multichannel retailers, there is little difference between the online price collected from a website and the offline price obtained by visiting the physical store: prices were identical about 72% of the time. Ancarani, Jacob, and Jallat (2009) reported that the list prices were lower online than offline, but the difference between online and offline list prices was minimal (within 8%). Similarly, Reinartz et al. (2017) reported in their study that 80% of product-specific average prices are cheaper online than offline.

In summary, the issue of whether to apply a price differentiation strategy or not remains unresolved for retailers offering multichannel experience (e.g. Kannan & Li, 2017), requiring research to investigate the extent to which price differentiation occurs between channels and why it occurs (Homburg et al., 2019).

Methodology

Study 1 was to identify multichannel retailers who applied price differentiation between online and offline channels. As reported by Gemius Polska (2022), apparel, shoes, cosmetics and perfume, books, records, films, pharmaceuticals, home electronics and appliances and sport apparel were the most popular categories bought online by at least half of the people buying online (Gemius Polska, 2022). Pharmaceuticals were excluded from the research as having a large part of the business in regulated pricing, and home and garden category was included following the Strategy& report (Strategy& — PwC, 2022). Based on Raport Omnichannel 2021 (YourCX, 2021), the retailers used most often were identified (threshold of ‘percentage of Internet users who bought at the retailer lately’ set at 20%): apparel: H&M, Reserved; shoes: CCC; cosmetics and perfume: Rossmann; multimedia (books, records, films): Empik; home electronics and appliances: RTV Euro AGD, Media Expert; and home and garden: Ikea, Castorama, Leroy Merlin. After additional desk research, two more categories and key retailers were added: kids: Smyk and sport: Decathlon. These 12 retailers’ webpages were manually scanned in search of price differentiation practices. To identify the price offered offline, the ‘check availability in store’ (or similar) buttons were used. Offer uniqueness was assessed based on having high or low share of nationwide items in the assortment.

Study 2 focused on those retailers who were identified to perform price differentiation between online and offline channels. Data scrapping using Python was performed to collect the prices in the course of November 2022. For Empik, product choice was based on top 100 rankings per product category available at the retailer’s webpage, and seven categories were analysed: stationery, films, games and apps, own collections, books, music and toys. For Smyk, product choice was based on bestsellers lists per product category available at the retailer’s webpage, and five categories were analysed: toys and games, apparel/shoes for kids, kid/mother, stationery and books. Remaining categories (apparel/shoes for adults, health and beauty, home and garden) were excluded from the study as they were only available online. In total, 3,460 prices were collected (1,496 for Empik and 1,964 for Smyk): standard price, price online and price offline. The cross-channel price differentiation was analysed per category, per position in the top 100/bestsellers ranking and per product absolute price.

Results and Discussion

Study 1

Study 1 aimed at identifying multichannel retailers applying price differentiation between online and offline channels. Among the retailers in scope, the majority of them offered information about the prices online and offline on their websites. They did it using the ‘check availability in store’ button (or similar), with which a customer could verify the availability and the price of a given item in a given store or find an item in the store nearby. The only retailer that did not offer such a button was Rossmann. For Reserved, although the ‘check availability in store’ button was available, the price in-store was not clearly stated. Therefore, for these two retailers, the verification of price differentiation was made in-store. As shown in Table 1, for a majority of the retailers, the channel price differentiation strategy was not observed. This is in line with previous research (Wolk & Ebling, 2010; Cavallo, 2017; Hitsch et al., 2021) that, despite possible customers’ acceptance of channel price differentiation, the retailers are not widely applying this strategy. For retailers that offer highly differentiated products (exclusively or with a high percentage of own-label items) for which direct price competition with online retailers is limited, this strategy seems to be justified as it prevents from any unfairness perceptions from customers. However, for retailers that offer nationwide brands, for which the direct price comparison with online retailers is at almost no cost to customers, such a strategy might comprise a threat to retailers’ profitability as the costs of offline operations are higher (Betancourt et al., 2016; Ratchford et al., 2022).

Among retailers in scope, only Empik and Smyk were found to perform channel price differentiation. For their offer of mixed uniqueness (nationwide brands and own-label or own-collection items), this strategy allows them to offer prices competitive to online retailers, while it also allows to recover higher costs of offline operations.

Among retailers in scope, only Empik and Smyk were found to perform channel price differentiation. For their offer of mixed uniqueness (nationwide brands and own-label or own-collection items), this strategy allows them to offer prices competitive to online retailers, while it also allows to recover higher costs of offline operations.

Study 2

Study 2 aimed at assessing the direction and extent of price differentiation performed by retailers who applied it. Both retailers in scope displayed similar patterns. Overall, 75% of Empik products were cheaper online, 3% were cheaper offline, and no price difference was observed for 22% of the products. In total, 78% of Smyk products were cheaper online, 8% were cheaper offline, and there was no price difference in case of 14% of the products (see Table 2).

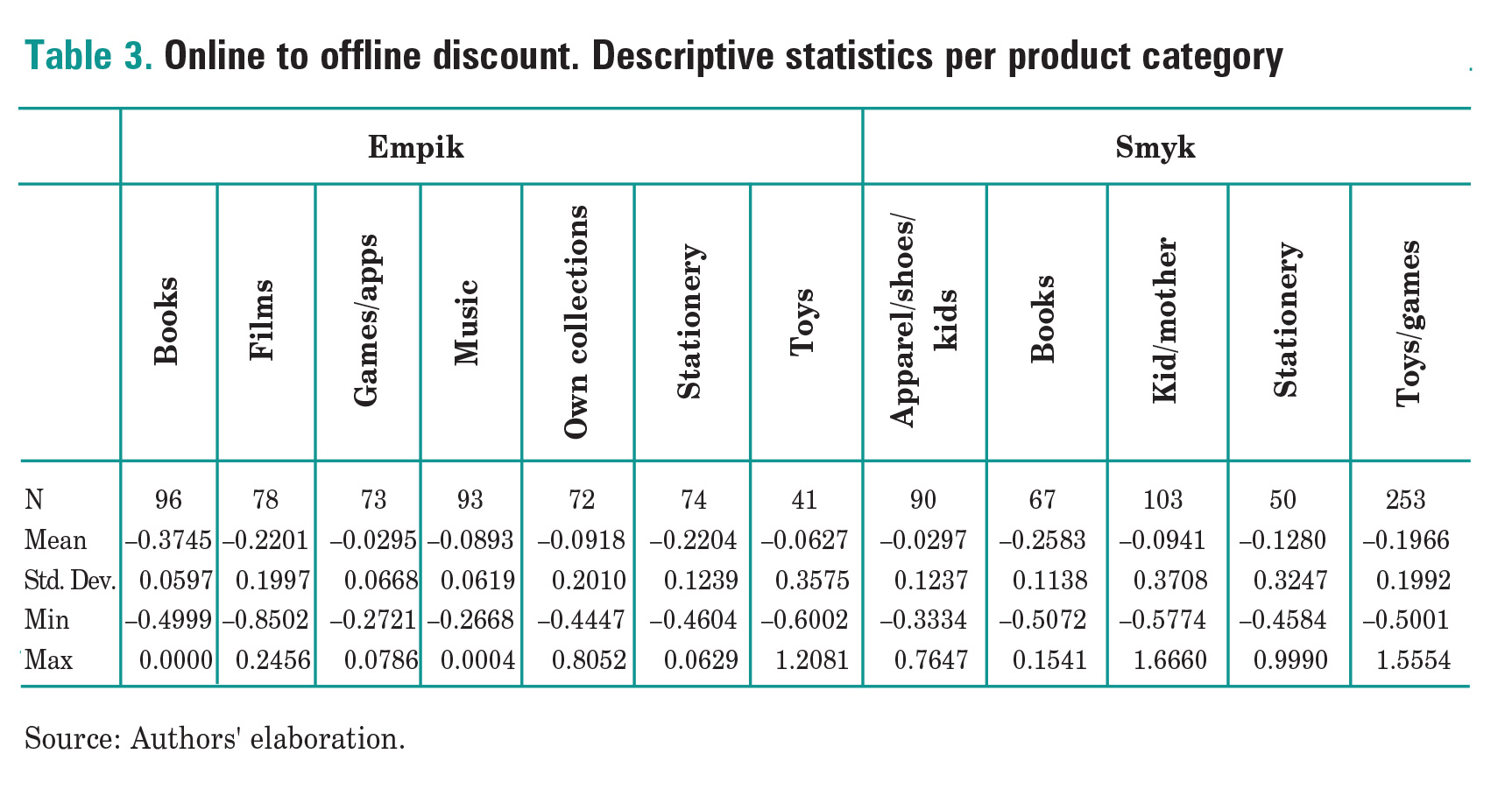

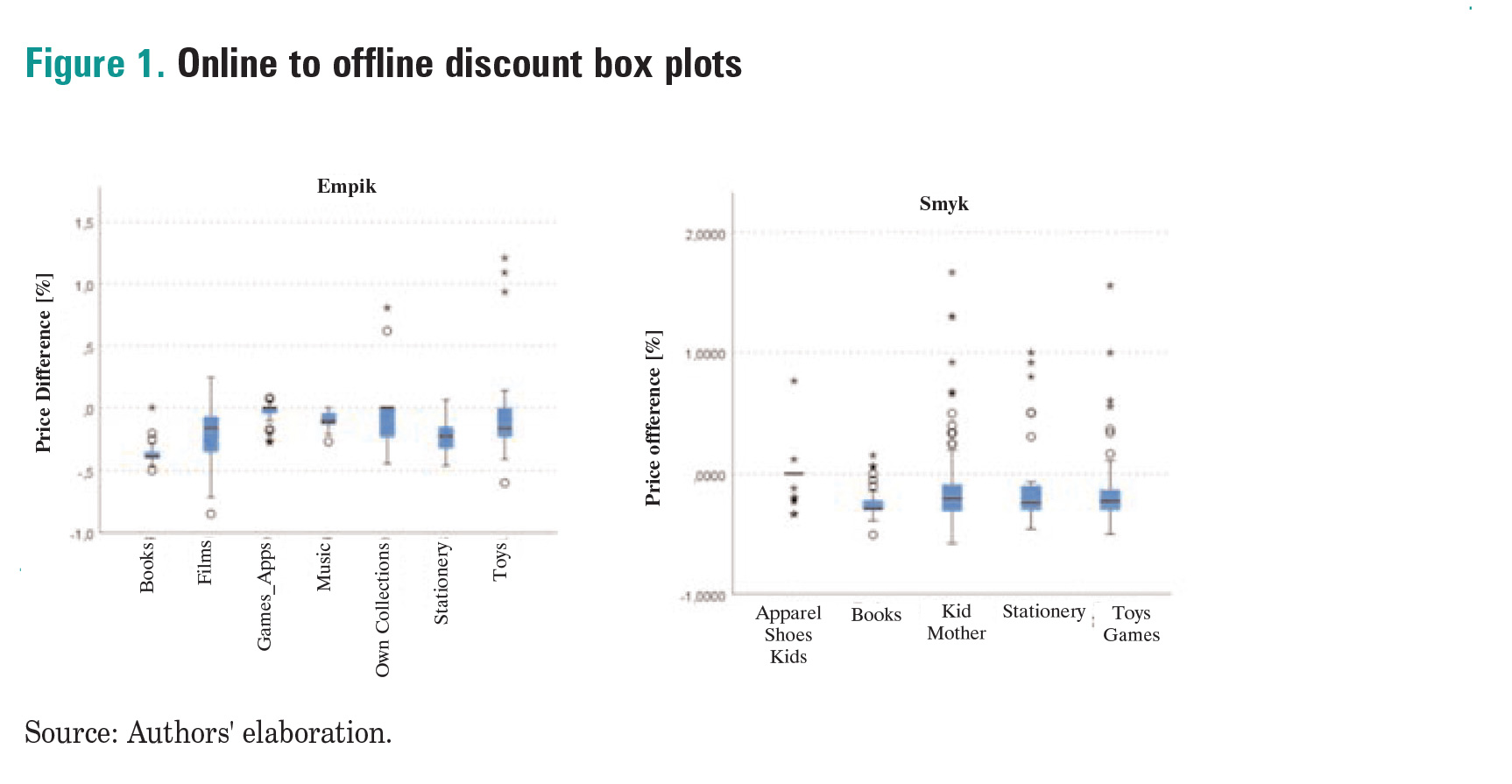

For Empik, online prices were, on average, consistently lower than offline prices across all categories. As presented in Table 3, the biggest price difference was visible in the books category, with the online prices being, on average, 37% lower. Stationery and films were 22% cheaper online. Remaining categories exhibited price discounts less than 10%. The total average was 16.9%.

For Smyk, we observed a similar pattern with products being cheaper online than offline. Except for apparel/shoes for kids category (2.9% price discount) and kid/mother (9.4% price discount), all other categories demonstrated a price discount higher than 10%. As in the case of Empik, the price discount was highest for books-almost 26%. Detailed discount dispersion per category is presented in Figure 1.

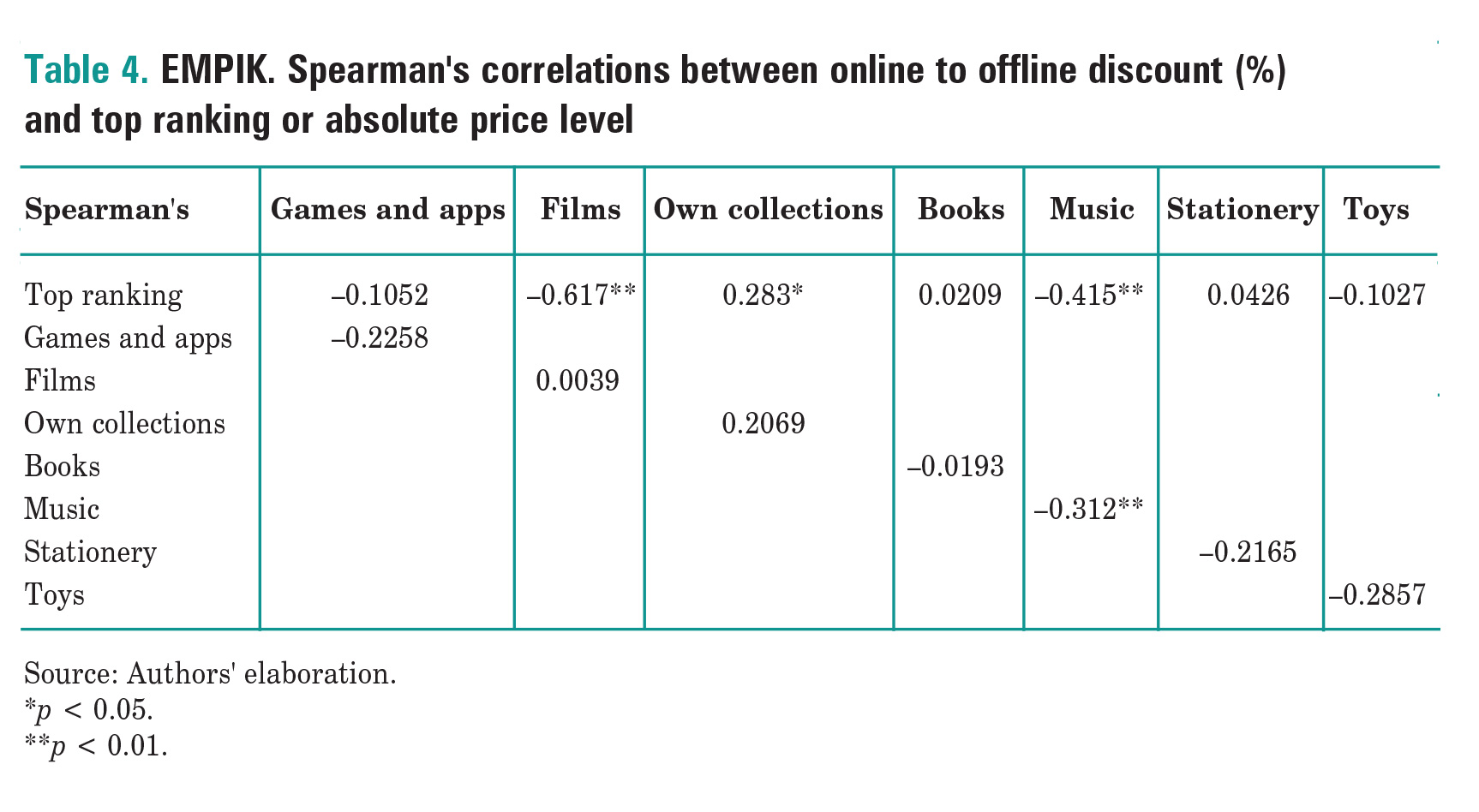

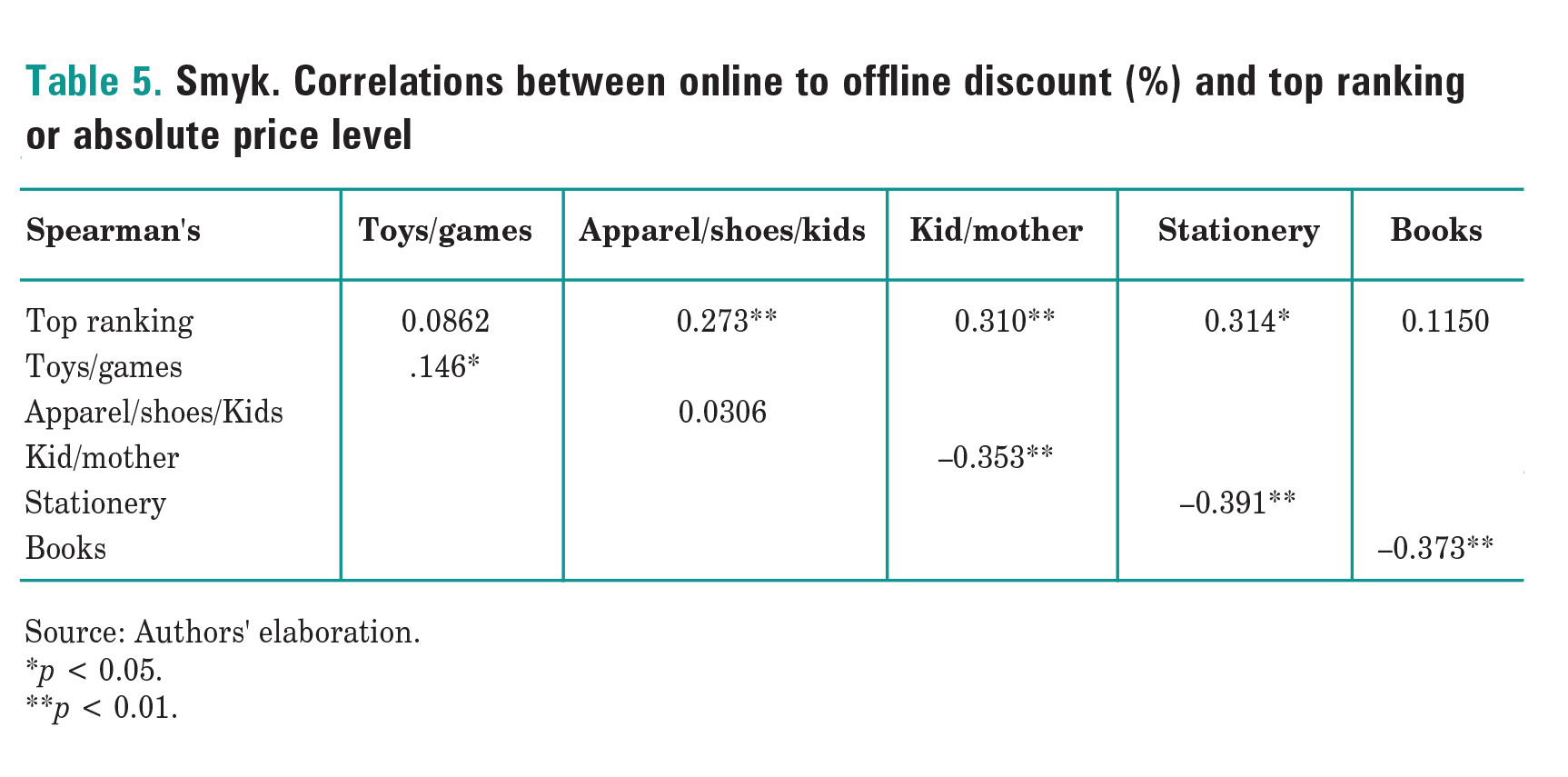

Another research question of this study was if online vs. offline price differentiation was related to top/bestsellers ranking or absolute price of the products. Spearman’s correlation coefficients for these variables are displayed in Tables 4 and 5. As far as top ranking was concerned, statistically significant negative correlations were estimated for films and music (Empik), which means that further down the top list, the higher discount to offline was used. On the contrary, statistically significant positive correlations were estimated for own collections and apparel/shoes for kids, kid/mother and stationery (Smyk). In those cases, further down the top list, the lower price discount (or even premium) to offline was detected.

As we could see, the strategy for multichannel price differentiation across top/bestsellers lists was not consistent among the categories. One could argue that for categories with low offer uniqueness (films, music), the top selling products were offered at similar online/offline prices, while for categories with high offer uniqueness (own collections for Empik and apparel/shoes for kids and kid/mother for Smyk), further down the top sellers list, the more equal prices or even online premiums appeared more often.

When it comes to the question of the relation between the price differentiation strategy and the absolute price level of the product, four categories displayed statistically significant negative relation between these variables: music (Empik), kid/mother, stationery and books (Smyk). It means that for these categories, the higher the absolute price, the lower price discount in online vs. offline was applied. However, these were categories having diverse characteristics in terms of offer uniqueness, average discounts online vs. offline, average absolute price levels and the share of products cheaper online; it is therefore difficult to draw consistent conclusions on the category specifics.

Conclusions

In summary, this research confirmed previous results (Wolk & Ebling, 2010; Cavallo, 2017; Hitsch et al., 2021) that online vs. offline price differentiation was not widely used by the leading multichannel retailers in the most popular categories bought online: only two out of 12 retailers elicited for the study were found to perform it. It also confirmed previous findings that if price differentiation was applied, the items were cheaper online more often: 76% of cases vs. 80% reported by Reinartz et al. (2017). However, the average depth of discount was considerably higher: 16.04% vs. 8% reported by Ancarani et al. (2009).

Apart from these general findings, our research delivered detailed insights at the category level as the depth of discount and the share of products sold at a discount online considerably differed across product categories. For categories with the unique offer (e.g. apparel/shoes for kids or own collections), the average discount online was relatively small, and the share of products offered at parity between the channels was relatively high. Another specific category exhibiting similar characteristics was games and apps, but here, the reason was the relatively high number of money equivalents (e.g. pre-paid unique codes) in the assortment. On the contrary, for categories with a non-unique offer (e.g. books or films), the share of items offered cheaper online and average discount online were among the highest. Additionally, this study provided a unique analysis of the multichannel price differentiation strategy in relation to popularity or the absolute price of the product. While in the case of the popularity of the product, the offer uniqueness seemed to play a role again, the relation to the absolute price of the product showed a mixed picture and would need further investigation.

The limitation of this study is that data collection was performed in one wave, while the repetition of the study could bring additional insights. Another limitation is that it focused on the leading multichannel retailers in the most popular categories bought online. At the same time, other retailers might be performing channel price differentiation strategies not elicited for this study. Furthermore, as the customers’ perception of fairness has been previously reported as a possible obstacle for retailers to implement online vs. offline price differentiation, future research could investigate Polish consumers’ attitudes toward this strategy. Finally, as this strategy aims at profit maximisation through the recovery of higher costs of offline operations, the profitability angle would also be an interesting path for future research.

References

1. Ancarani, F., Jacob, F., & Jallat, F. (2009). Cross-country analysis of price levels and dispersion in online and offline environments: An empirical analysis in France and Germany. Journal of Product and Brand Management, 18(7), 497–505. doi:10.1108/10610420910998226

2. Betancourt, R., Chocarro, R., Cortinas, M., Elorz, M., & Mugica, J. M. (2016). Channel choice in the 21st century: The hidden role of distribution services. Journal of Interactive Marketing, 33, 1–12.

3. Bondos, I. (2016). Różnicowanie cen w handlu wielokanałowym — wyzwanie wizerunkowe. Handel wewnętrzny, 5(364), 17–26. Retrieved from http://cejsh.icm.edu.pl/ cejsh/element/bwmeta1.element.desklight-a361448c-200f-441a-9b7e-06ed1f54d37b Accessed 2022-09-20

4. Breugelmans, E., & Campo, K. (2016). Cross-channel effects of price promotions: An empirical analysis of the multi-channel grocery retail sector. Journal of Retailing, 92(3), 333–351. doi:10.1016/j.jretai.2016.02.003

5. Cavallo, A. (2017). Are online and offline prices similar? Evidence from large multichannel retailers. American Economic Review, 107(1), 283–303. doi:10.1257/aer.20160542

6. Fassnacht, M., & Unterhuber, S. (2015). Cross-channel pricing: What we know and what we need to know. International Journal of Business Research, 15(2), 39–60. doi:10.18374/IJBR-15-2.4

7. Fassnacht, M., & Unterhuber, S. (2016). Consumer response to online/offline price differentiation. Journal of Retailing and Consumer Services, 28, 137–148. doi:10.1016/j.jretconser.2015.09.005

8. Gemius Polska, (2018). E-commerce w Polsce 2018. Retrieved from https://www.gemius.pl/wszystkie-artykuly-aktualnosci/internauci-zaufali-e-sklepomraporte-commerce-w-polsce-2018-juz-dostepny.html Accessed 2022-09-24

9. Gemius Polska, (2022). E-commerce w Polsce 2022. Retrieved from https://www.iab.org.pl/aktualnosci/raport-e-commerce-2022-juz-dostepny/ Accessed 2022-09-24

10. Hammami, R., Asgari, E., Frein, Y., & Nouira, I. (2022). Time- and price-based product differentiation in hybrid distribution with stockout-based substitution. European Journal of Operational Research, 300(3), 884–901. doi:10.1016/j.ejor.2021.08.042

11. Hitsch, G. J., Hortaçsu, A., & Lin, X. (2021). Prices and promotions in U.S. retail markets. Quantitative Marketing and Economics, 19(3–4), 289–368. doi:10.1007/s11129-021-09238-x

12. Homburg, C., Lauer, K., & Vomberg, A. (2019). The multichannel pricing dilemma: Do consumers accept higher offline than online prices? International Journal of Research in Marketing, 36(4), 597–612. doi:10.1016/j.ijresmar.2019.01.006 13. Hufnagel, G., Schwaiger, M., & Weritz, L. (2022). Seeking the perfect price: Consumer responses to personalized price discrimination in e-commerce. Journal of Business Research, 143(September 2021), 346–365. doi:10.1016/j.jbusres.2021.10.002

14. Kannan, P. K., & Li, H. “Alice.” (2017). Digital marketing: A framework, review and research agenda. International Journal of Research in Marketing, 34(1), 22–45. doi:10.1016/j.ijresmar.2016.11.006

15. Kireyev, P., Kumar, V., & Ofek, E. (2017). Match your own price? Self-matching as a retailer’s multichannel pricing strategy. Marketing Science, 36(6), 908–930. doi:10.1287/mksc.2017.1035

16. Li, Y., Gordon, B. R., & Netzer, O. (2018). An empirical study of national vs. Local pricing by chain stores under competition. Marketing Science, 37(5), 812–837. doi:10.1287/mksc.2018.1100

17. Narwal, P., & Nayak, J. K. (2020). Towards a new price discrimination strategy: Exploring Pay-What-You-Want pricing in multi-channel retailing. Asia Pacific Journal of Marketing and Logistics, 32(4), 975–998. doi:10.1108/APJML-01-2019-0037

18. Neslin, S. A., & Shankar, V. (2009). Key issues in multichannel customer management: Current knowledge and future directions. Journal of Interactive Marketing, 23(1), 70–81. doi:10.1016/j.intmar.2008.10.005

19. Neslin, S. A., Grewal, D., Leghorn, R., Shankar, V., Teerling, M. L., Thomas, J. S., & Verhoef, P. C. (2006). Challenges and opportunities in multichannel customer management. Journal of Service Research, 9(2), 95–112. doi:10.1177/1094670506293559

20. Ratchford, B., Soysal, G., Zentner, A., & Gauri, D. K. (2022). Online and offline retailing: What we know and directions for future research. Journal of Retailing, 98(1), 152–177. doi:10.1016/j.jretai.2022.02.007

21. Reinartz, W., Haucap, J., Wiegand, N., & Hunold, M. (2017). Price differentiation and dispersion in retailing. Selected Publications of the IFH-Förderer, 6, 1–20.

22. Richards, T. J., Liaukonyte, J., & Streletskaya, N. A. (2016). Personalized pricing and price fairness. International Journal of Industrial Organization, 44, 138–153. doi:10.1016/j.ijindorg.2015.11.004

23. Strategy& — PwC (2022). Perspektywy rozwoju rynku e-commerce w Polsce 2018–2027. Retrieved from https://www.pwc.pl/pl/pdf-nf/2022/Raport_Strategyand_Perspektywy _rozwoju_rynku_e-commerce_w_Polsce_2018-2027.pdf Accessed 2022-09-24

24. Wolk, A., & Ebling, C. (2010). Multi-channel price differentiation: An empirical investigation of existence and causes. International Journal of Research in Marketing, 27(2), 142–150. doi:10.1016/j.ijresmar.2010.01.004

25. YourCX, (2021). Raport Omnichannel 2021. Retrieved from https://yourcx.io/pl/ omnichannel-2021/ Accessed 2022-09-24

Ewa Kiczmachowska, PhD — practitioner with 25-year experience in business, PhD in Management (2010), since 2020 Assistant Professor at Kozminski University, Warsaw, Poland, Faculty of Marketing. Her research interests include revenue management and pricing strategies in the digital business models. Her latest research covered revenue management practices in peer-to-peer accommodation services, with special attention to dynamic pricing and crisis management.

Paweł de Pourbaix , PhD — PhD in Management, Assistant Professor at Kozminski University, Warsaw, Poland, Faculty of Marketing. Head of Bachelor Program in Marketing, specialized with marketing, market analysis, sales strategies and customer service. Lecturer at bachelor, master and postgraduate programs. His research interests include young consumers’ behavior, relationship marketing and sales management. Author and co-author of papers and monographs in renowned journals and scientific publications related to marketing.

Professor Dariusz Jemielniak — Full Professor at Kozminski University, Warsaw, Poland, Faculty of Management in the Network Society. He specializes in the strategy of organizations in the technology (Internet) industry and the study of open collaboration community. He holds a master’s degree (2000), Ph.D. (2004), habilitation (2009), and professorship in management, along with another habilitation in sociology (2019). Since 2015, he has been working as a faculty associate at the Berkman Klein Center for Internet and Society at Harvard University. Major research internships in: Cornell University; Harvard University; the University of California, Berkeley; the Massachusetts Institute of Technology. The winner of many prestigious awards and research grants.